Turkey—High inflation and low interest rates threaten economic crisis

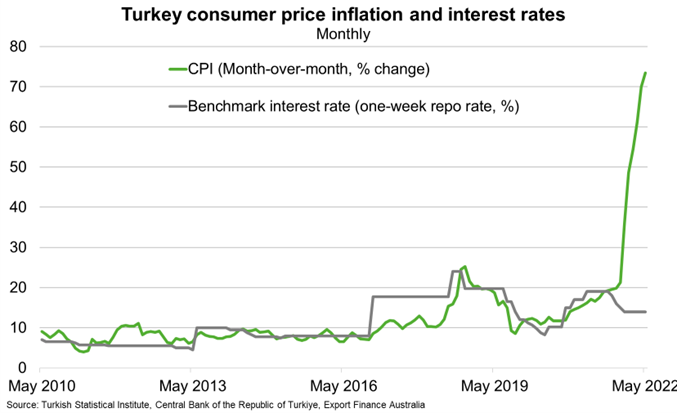

Inflation spiralled to 73.5% year-on-year in May due to currency weakness, high energy and agricultural commodity prices, and President Erdogan’s unorthodox insistence on low interest rates. Turkey’s central bank (TCMB) cut benchmark interest rates by 500 basis points from September to December 2021 and has retained rates at just 14% in the first half of 2022, despite spiralling inflation (Chart). President Erdogan advocated for further interest rate cuts this month and a ‘new economic model’ that aims to tame inflation by harnessing the weak currency to boost exports and investment rather than using higher borrowing costs to suppress consumption and prices. The lira subsequently reached a new record low against the US dollar this month, having shed 30% over 2022 to date. While deeply negative real interest rates will support corporate and consumer demand and economic activity, it will also contribute to inflation and import demand. The mix of low interest rates, currency weakness and high inflation is therefore likely to continue.

Tighter global financial conditions, regional conflicts and tension, domestic economic instability and policy uncertainty will deter capital inflows. Capital inflows are likely to be insufficient to offset the widening current account deficit and service sizeable public and private foreign debt. Foreign exchange reserves, which stand at US$61 billion, may fall further. Ahead of elections that must take place before June 2023, the risk of political violence is possible. Economic hardship for groups unable to increase their incomes in line with prices will add to socio-political tensions. This raises the risk of a financial crisis and economic recession in Australia’s 40th largest export market.