Japan—Export boom temporarily boosts economic performance

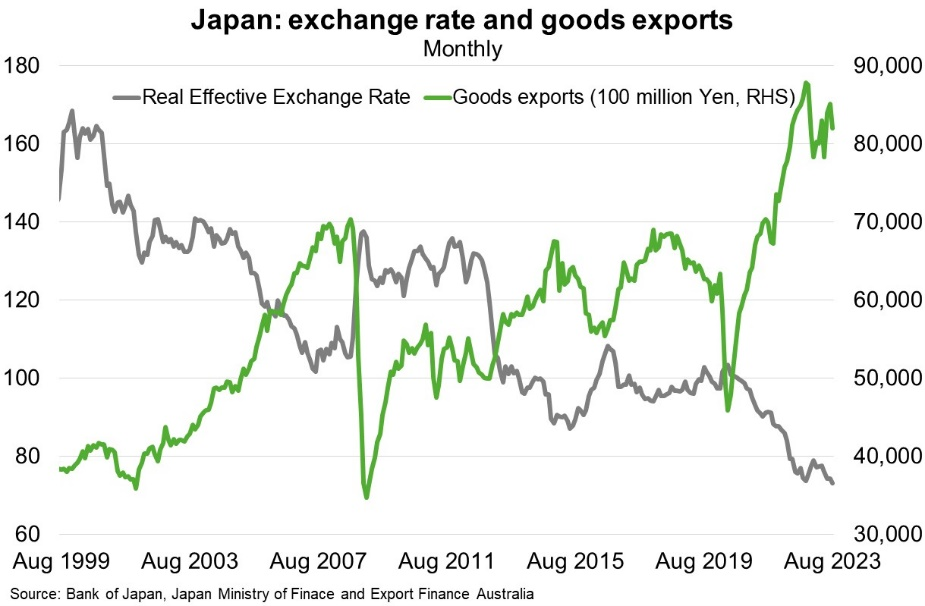

Japan, the world’s fourth largest economy and Australia’s second largest export market has been buoyed by a surge in inbound tourism and car exports. GDP grew by a sharp 4.8% on an annualised basis during Q2 2023. The IMF subsequently revised up its expectations for Japan’s economy to grow 2.1% in 2023, from 0.5% in 2022. Near record exports reflect a) the weakest real yen ever (Chart), b) the normalisation of international travel to pre-pandemic volumes, and c) resolution of supply chain issues.

Strong GDP growth will tighten labour markets and exert upward pressure on wages —which finally started to rise earlier this year—indicating Japan’s multi-decade period of deflation and weakly rising prices may end. Still, the Bank of Japan is likely to continue its ultra-accommodative monetary policies until substantive evidence emerges of real wages growth fuelling increased household confidence and a sustained rise in domestic demand. The Tankan business confidence survey for large firms rose for the third consecutive quarter in the September quarter, highlighting growing business confidence amid moderating inflation.

However, Japan’s recent performance is likely a short-term deviation from permanently slower growth. The IMF forecasts GDP growth to moderate to 1.0% in 2024 and average 0.5% per annum over the following four years. This reflects the declining population and stagnant productivity, slowdowns in major foreign markets and high input costs which will dampen exports, despite higher domestic consumption and government spending. That said, Prime Minister Kishida unveiled a new economic plan in late September designed to create a virtuous growth cycle by spurring wages growth and business investment, particularly in strategic industries. The proposed measures include expanded tax benefits and deductions for businesses alongside higher social provisions that, if successfully implemented, may help to end Japan’s decades of economic stagnation.