China—Rising industrial demand supports Australian resources exports

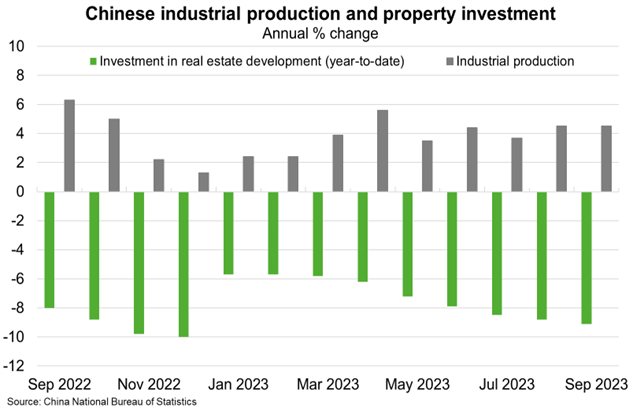

Despite structural impediments to growth, China’s economy shows some signs of stabilising on the back of policy support measures. On a quarter-by-quarter basis, real GDP grew 1.3% in Q3, accelerating from a revised 0.5% in Q2. In particular, continued growth in industrial production is helping to support domestic demand and offset ongoing weakness in property investment and construction (Chart).

Industrial demand is supporting Chinese imports of commodities important to Australian exporters. China was the largest market for Australian’s resources and energy exports in FY2022, accounting for more than 35% of export earnings. China is also one of the largest consumers of energy and metals globally. The volume of Chinese iron ore imports rose 1.5% year-over-year in September and are 6.7% higher year-to-date. Chinese coal imports jumped 28% year-over-year in September and 73% year-to-date. Following the end of trade impediments on Australia coal imports, Australian thermal coal exports to China have returned to previous levels. That said, Australian metallurgical coal has been challenged by growing competition from Russian and Mongolian supply.

The Department of Industry, Science and Resources’ September 2023 Resources and Energy Quarterly (REQ) shows commodity prices have held up better than expected. Moreover, the outlook for Australian resource and energy exports has improved slightly relative to three months ago. Still, the REQ projects Australian resources and energy exports to fall to $400 billion in 2023-24 and $352 billion in 2024-25, down from a record $467 billion in 2022-23. That said, additional fiscal stimulus measures being considered by Chinese policymakers may add upside to export forecasts. Beijing reportedly may issue at least RMB1 trillion (around US$137 billion or about 0.8% of GDP) of additional sovereign debt for spending on infrastructure. China’s stabilising economy would support demand for, and prices of, Australian commodities, in the near term.