Australia—Long term critical minerals’ export prospects remain intact

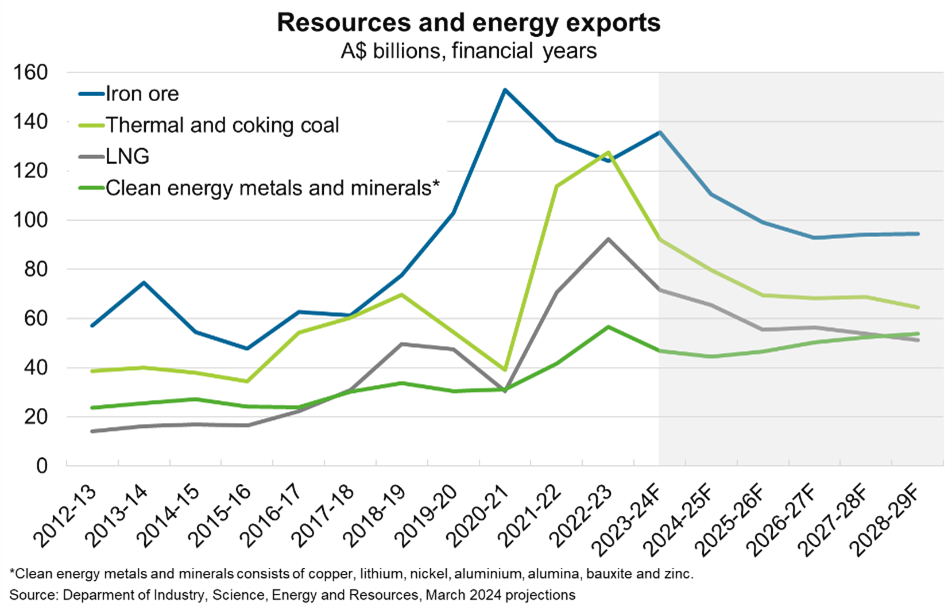

Australia’s resources and energy exports are forecast to fall from record highs of $466 billion in 2022-23 to $417 billion in 2023-24 and $366 billion in 2024-25 according to the Department of Industry, Science and Resources. This outlook reflects weaker world demand growth and rising commodity supply—that lowers global prices—and a predicted rise in the Australian dollar against the US dollar.

Prices for critical minerals have fallen sharply from their highs in late 2022 and early 2023 in response to slower growth in demand for electric vehicles and increased material supply. The price of spodumene concentrate (lithium) is forecast to average US$1,139 in 2024, nearly 70% lower than in 2023. Lower prices alongside reduced export volumes are expected to reduce Australian clean energy metals and minerals export earnings in 2023-24 and 2024-25. But structural demand drivers—particularly increasing investment in low emission technologies, underpinned by the global transition toward net zero emissions—remain positive for critical minerals over the longer term, including copper, aluminium, lithium, nickel and rare earths.

Indeed, beyond 2024-25, rising exports of clean energy metals and minerals buck the downward trend seen for other commodities (Chart). Lower prices and demand for carbon-intensive exports are expected to contribute to lower returns from fossil fuels exports. And China’s shift toward a less steel-intensive economy will weigh on iron ore exports. Importantly, though, export returns in general through 2028-29 are forecast to remain higher than historical standards amid continued industrial demand from key Asian markets. In particular, commodity prices will benefit from growing demand from India alongside its strong infrastructure investment push. China’s higher-than-expected real GDP growth of 5.3% year-on-year in Q1 2024 also suggests the world’s second largest economy remains resilient to property troubles and challenging global conditions.