Major export markets—Emerging Asia mostly less exposed to risks

Emerging Asia mostly less exposed to risks

The IMF expects real GDP growth in emerging markets (EM) to remain broadly steady at 4% in 2024 after similar outputs in 2022 and 2023. Weak global trade will curb growth in export-led EMs (such as China and Vietnam), while domestic-focused economies hold up better (such as India and Indonesia). However, volatile commodity prices could derail slowing inflation and make it more difficult for EM central banks to ease monetary policy. Bad weather has already started to hit crop yields and raise domestic prices in India and across Latin America. Debt repayment risks will remain high for many EMs in the face of ongoing tight external and domestic financing conditions. The risk of rising political tensions and social unrest, possibly related to another flare in inflation, could dent economic momentum and heighten financial risks.

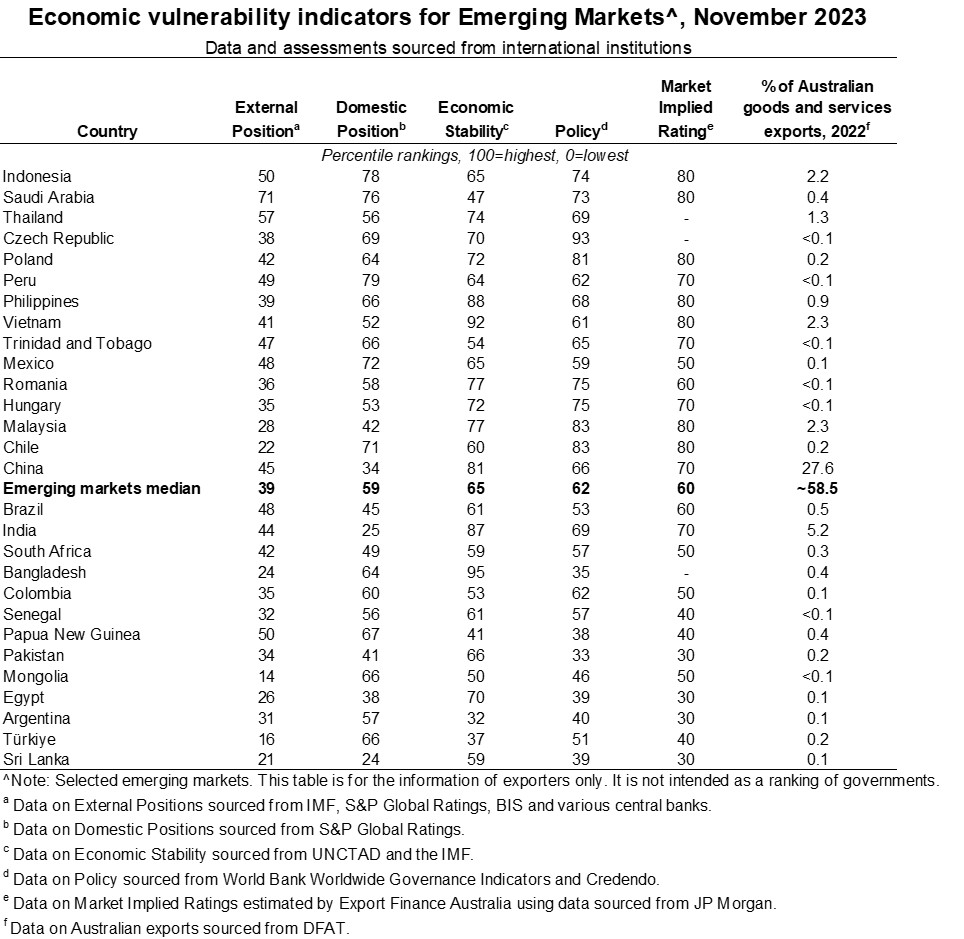

International institutions and financial market analysts, including the IMF, World Bank and S&P Global Ratings, use a range of indicators to assess the EMs most exposed to these risks.

- External position—what is the external debt and reserves position? Is the current account in deficit and how far has the currency deviated from its long term average?

- Domestic position—how leveraged is the private and public sector?

- Economic stability—what is the growth and inflation outlook? How reliant is the country on commodity exports, given the volatility in global commodity prices?

- Policy effectiveness—how effective is the regulatory environment and how severe are political risks?

- Market implied ratings—what do market risk premiums on foreign currency denominated bonds imply about market risk appetite?

Based on these indicators, many of Australia’s major emerging Asia export markets—such as Indonesia, Thailand, Philippines, Vietnam, Malaysia and China—are relatively less exposed. Rising incomes and favourable demographics support Indonesia’s economic strength, while increasing infrastructure investment and reforms to remove regulatory obstacles and labour market rigidities are enhancing the business environment. Vietnam’s diverse economy, resilient foreign investment inflows, integration in global supply chains, relative political stability, low labour costs and large population supports robust, albeit declining, economic growth prospects and helps mitigate risks a downturn in property markets and banking stress. The Philippines benefits from robust, albeit slower, economic growth, progress on reforms to enhance the business environment, a lengthening track record of broad monetary and financial stability, a moderate government debt burden and robust external position. China has capacity to withstand further global economic and financial volatility, though the property market downturn remains a source of weakness. Recovery in international tourism is supporting steady economic growth in Thailand, which alongside stable inflation and solid external finances, reduces macro-financial vulnerabilities.

Other major export markets sit below the emerging market median. In Brazil, high government debt, fiscal rigidities and weak potential economic growth contribute to moderate vulnerabilities, despite a recent boost from higher commodity prices and progress on reforms. Bangladesh is challenged by high inflation, political and social tensions ahead of elections due in January, and tightening foreign exchange liquidity in the banking system. South Africa’s ailing power infrastructure weakens the economic outlook, challenges the government’s ability to deliver public services and raises risks of social unrest. PNG remains at high risk of debt distress despite benefiting from higher commodity prices, IMF funding and reforms, and optimism about investment in large gas projects. More broadly, significant economic and financial pressures and elevated public debt levels in Sri Lanka, Türkiye, Argentina, Egypt and Pakistan leave these countries more exposed to further global economic weakness, tight financing conditions, and political and social tensions.