Australia—Exports resilient, but tight labour markets challenge SMEs

Exports resilient, but tight labour markets challenge SMEs

Australian exports are proving resilient to weakening global economic conditions. Although goods exports fell to $46 billion in September 2023, down from a peak of $55 billion in June 2022, they are still well above the 2019 monthly average of $33 billion. Resources exports remain strong thanks to industrial demand from China and growing demand for metals and minerals in clean energy products. Rural commodities are also performing well; for instance, record meat exports in September resulted from robust demand from the US and China. Fewer supply disruptions and lower freight costs are supporting businesses access to imports and, in turn, export confidence. Australian exporters are also more price competitive thanks to depreciation of the Australian dollar, which has fallen 17% since the recent peak in February 2021 to US66 cents (below its 30-year average of US76 cents).

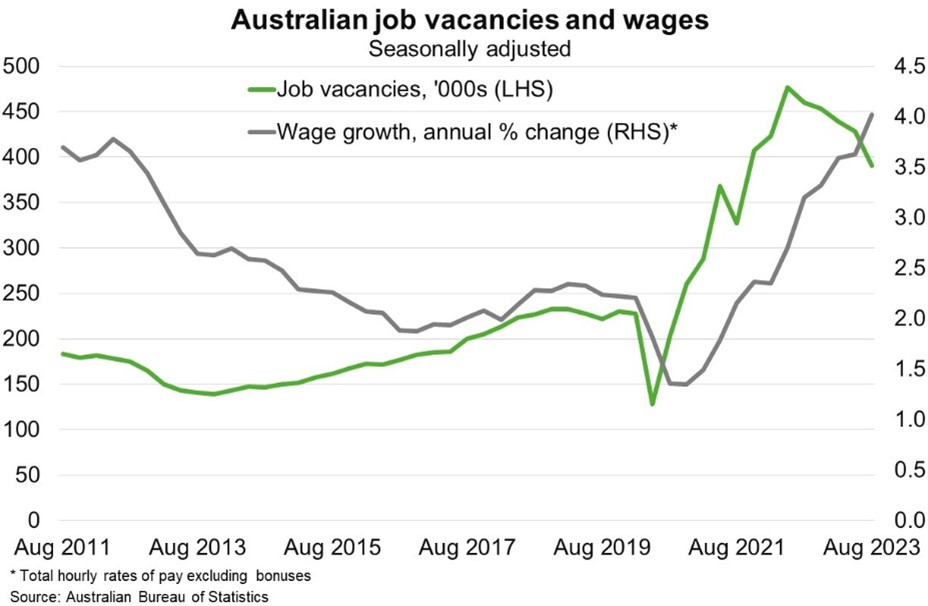

Despite some easing over the past year, ongoing labour shortages remain a significant headwind. Net overseas migration—expected to rise to 715,000 between July 2022 and June 2024—is helping to ease labour shortages and wage pressures in some industries, such as hospitality. But it has not materially lowered overall wage growth because migrants add to overall goods and services demand and hence increase the demand for labour. As a result, job vacancies remain high relative to historical norms (Chart). Wage growth will likely remain high before the slowing economy sees unemployment begin to rise. As the global economy slows, the scope to pass on high labour and other input costs to Australian export customers may fall, squeezing business profits. Indeed, ASIC Australian insolvency data shows that 3,403 companies have entered external administration or had a controller appointed from July to October 2023, 35% higher than in the same period last year.