Australia—Demand for iron ore and base metals lifts resources exports

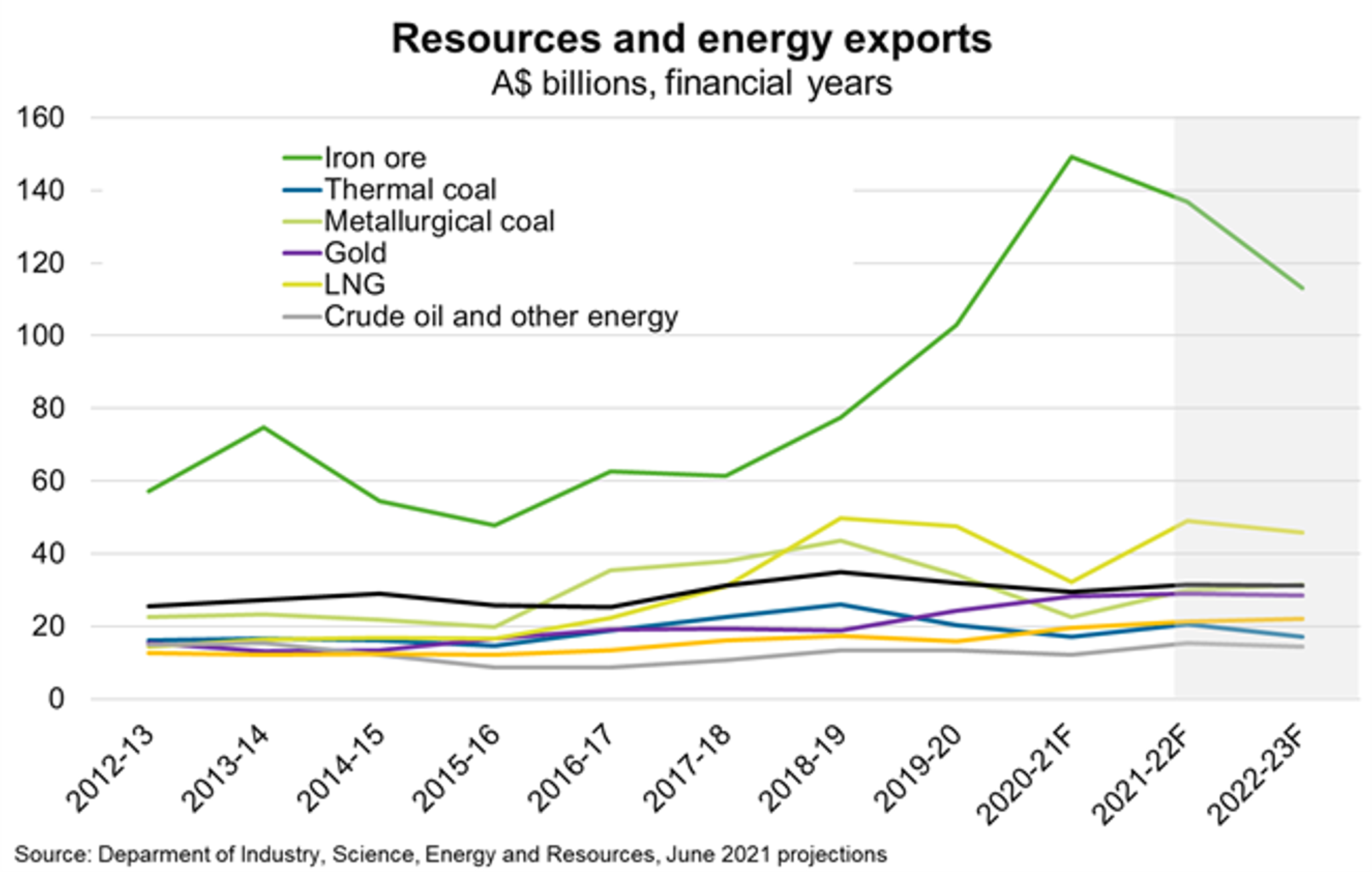

Australia’s resources and energy exports are forecast to rise from $310 billion in 2020-21 to a record $334 billion in 2021-22 and remain high at about $300 billion in 2022-23. Iron ore exports are estimated to have risen 50% to a record $149 billion in 2020-21 (Chart), underpinned by surging prices amid strong Chinese demand and supply issues in Brazil. Prices are expected to moderate and see iron ore export earnings fall over the coming years. However, a rebound in services facilitated by the COVID-19 vaccine rollout in major advanced economies is expected to support oil prices, filtering through to a predicted increase in global oil and LNG exports. Higher base metals export projections reflect resurgent global industrial activity. For instance, copper prices recently hit record-highs amid strong demand and concerns of higher taxes leading to lower investment in South American mines.

Coal will remain an important export in the near-term for Australia. Metallurgical coal export volumes to South Korea, India and Japan have been on a rising trend since the second half of 2020, helping to partly offset lower exports to China. Thermal coal exports are projected to recover in 2021-22 on the back of growing industrial production and electricity consumption in India and the rest of Asia.

But carbon intensive exports will weaken in the medium term as major economies focus on reducing greenhouse gas emissions, including through carbon pricing mechanisms. The outlook for LNG remains strong compared to other fossil fuels, and is bolstered by comparatively lower costs and carbon emissions from production and combustion. Australia is set to capture growing demand for resources used in new and low emission technologies, in particular copper, lithium and nickel, which are used in the production of electric vehicles and the global shift towards “greener” electricity generation.