China—Heavily leveraged property sector poses a risk to economic outlook

China’s second largest property developer Evergrande is facing a debt crisis, with liabilities of over US$300 billion. Evergrande concedes its cash flow is under ‘tremendous pressure’. Work has been suspended on some of its 778 projects after payments to suppliers were delayed, sparking protests from homebuyers, contractors and investors. Evergrande’s woes illustrate risks surrounding China’s heavily leveraged property sector, which has been a driver of the country’s exceptional GDP growth for decades. The deteriorating real estate outlook owes to rising borrowing costs and falling property sales. In part this owes to Beijing’s deleveraging campaign—the ‘three red lines’ policy entails a trio of metrics to assess selected developers’ financial situation that is essentially reducing developers' access to construction loans.

Authorities have shown less willingness over recent years to prop-up indebted companies, in order to rein in unsustainable debt. But while Beijing desires more market discipline, policymakers are unlikely to allow a disorderly default by Evergrande. A loss of confidence in the property market would curb household wealth and consumption.

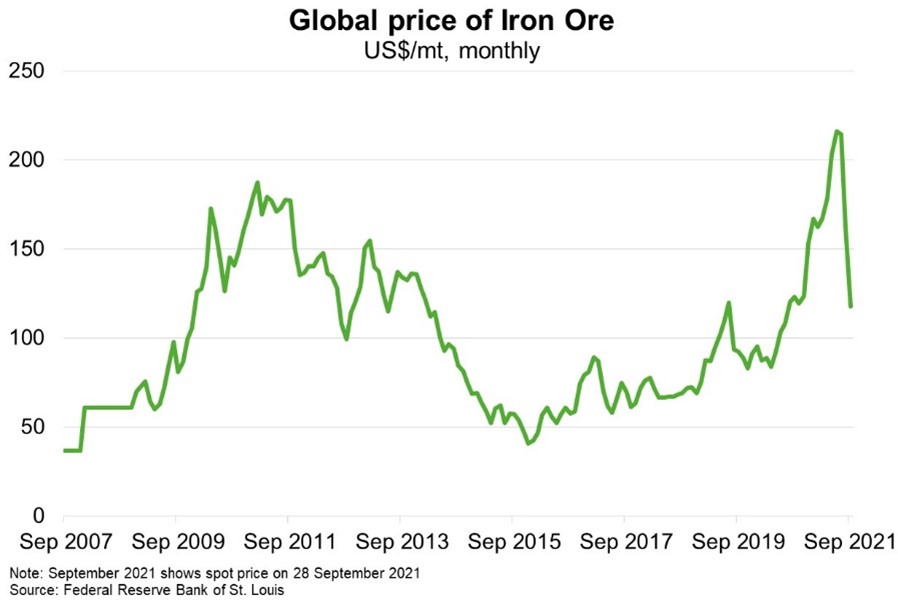

China’s property sector is a key source of demand for Australian commodities. Iron ore prices have almost halved (Chart) from record highs in May, driven by broader demand-side factors, alongside an increase in supply. After booming steel production in the first half of 2021, China’s production has lowered, a result of seasonal factors, tapering infrastructure spending, production caps and environmental emissions controls, as well as supply chain bottlenecks and high raw materials costs. A new COVID-19 outbreak in the manufacturing hub of Fujian province, and increased emphasis on the concept of ‘common prosperity’, is also weighing on sentiment. This poses further headwinds to slowing economic momentum in Australia’s largest export market.