World—Russian gas cut would raise global energy prices, dent growth

Russia’s energy exports to Europe have been curtailed since the Ukraine war began. Russian energy giant Gazprom recently announced gas flows through its largest pipeline—Nord Stream 1—would fall to 20% of capacity. Surging energy prices are undermining economic confidence, eroding households' purchasing power and suppressing European growth.

According to the IMF, a total shutdown in Russian energy supply to Europe would entail substantially more economic pain and political turbulence. Central and Eastern Europe are particularly exposed amid a) high dependence on Russian energy and b) integration into German supply chains likely to be impacted by industrial energy rationing. The IMF estimates annual GDP growth could shrink by 6% for the most-affected countries—Hungary, Slovak Republic and Czech Republic. The effects on Italy, Austria and Germany would be less severe but still significant. Firm profitability in energy-intensive industries like chemicals, steel, glass and fertilisers will fall disproportionately. But higher prices and falling confidence would also hinder sectors like machinery and car manufacturing. Fraying EU solidarity on gas sharing or a severe winter could make things worse.

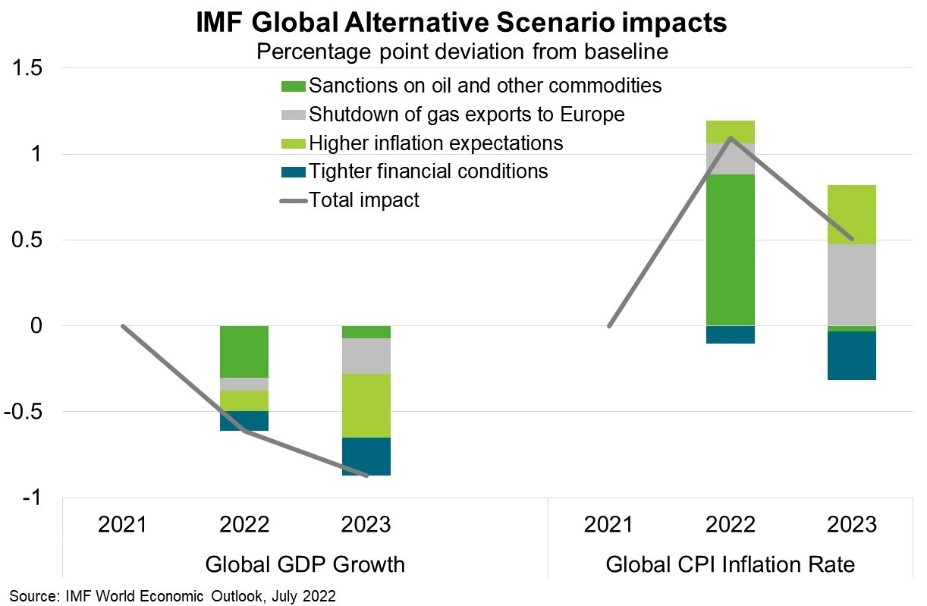

Higher commodity prices, tighter monetary conditions and renewed supply disruptions would also have global implications. The IMF forecast a scenario where Russian gas exports to Europe decline to zero by end-2022 and tighter sanctions cause an extra 30% fall in Russian oil exports. Under this scenario, inflation expectations remain persistently elevated and financial conditions tighten. This sees global growth fall (0.6ppt relative to baseline) to 2.6% in 2022 and (0.9ppt relative to baseline) to 2% in 2023 (Chart). On only five occasions since 1970 has global growth been lower than 2%. Worsening economic headwinds would increase challenges for the bulk of Australian exporters. However, higher oil and gas prices and European efforts to secure alternative energy supplies would benefit Australia’s resources exports, helping to offset some of the effects of higher priced imports, including fertiliser, fuel and industrial goods.