Southeast Asia—Robust economy offers Australian export prospects

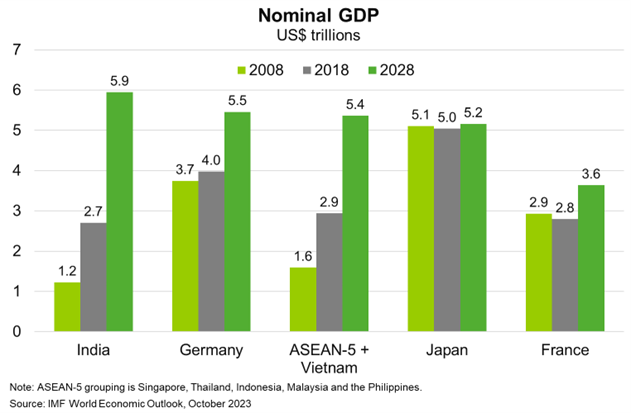

The outlook for major Southeast Asian economies (Singapore, Thailand, Indonesia, Malaysia, Philippines, the ASEAN-5, and Vietnam) is bright amid rising incomes, large and youthful populations (55% of the population is aged under 35) and continued urbanisation and industrialisation. These economies should continue to attract strong foreign direct investment inflows, as firms diversify their manufacturing supply chains. Continued growth in international travel and prospects for monetary easing in 2024 further support the outlook. These factors are poised to deliver 4.8% real GDP growth, on average, every year over the five years to 2028. By 2028, GDP in the ASEAN-5 region and Vietnam as a bloc, is projected to reach US$5.4 trillion, nearly double 2018 levels (Chart). This would mean the combined size of these economies is similar to the GDP of India and Germany, making the ASEAN-5 and Vietnam bloc among the largest economic groups in the world.

Southeast Asia is a growing market for Australian exporters. Exports to the ASEAN-5 and Vietnam rose to $89 billion in FY2023, almost double FY2018 levels, and now contribute 13% of total exports. A record 23% of agriculture and fisheries exports went to the ASEAN region in FY2023. The recent ASEAN-Australia Special Summit offered a range of new and expanded Australian government initiatives to support opportunities for Australian exporters to Southeast Asia. Overall, strong government spending on infrastructure, including record levels of investment in the clean energy transition, supports demand for Australian metals and minerals. To execute infrastructure plans, Australian service-oriented industries, such as design and engineering and education and training, stand to benefit. The middle class, already numbering at least 190 million people, is large and expanding. Indonesia is on track to add another 76 million middle-income consumers by 2030 (more than 25% of the population) compared to 2020. This boost to consumer spending power should lift demand for higher-value Australian goods and services, including healthcare, education, tourism and premium food and beverages.