Australia—Energy demand drives record-high commodities exports

Australia posted its third consecutive record trade surplus in August, as surging coal and LNG exports more than offset a sharp decline in iron ore. Indeed, Australia’s resources and energy exports are forecast to rise 13% to a record $349 billion in 2021-22, driven by a stronger outlook for coal, LNG and base metals exports and a weaker Australian dollar. Some moderation in resources and energy prices is likely in 2022, as supply rises and demand growth moderates, leading to lower but still high export receipts of $300 billion in 2022-23.

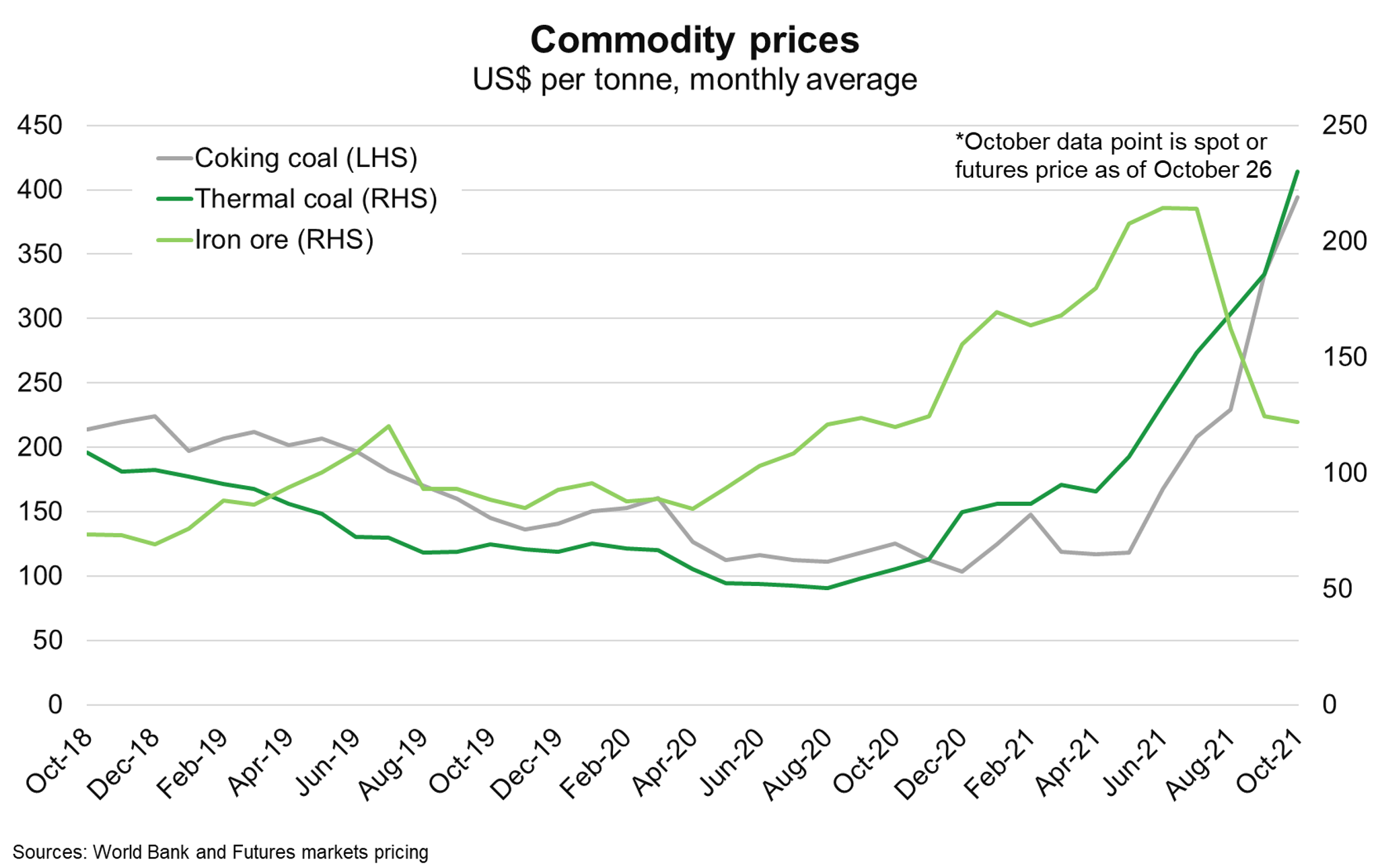

A spike in prices (to record-highs for thermal and coking coal) are benefiting Australia’s coal and LNG exporters. Higher prices reflect growing energy demand in Europe and China and significant supply shortages related to bad weather, labour disruptions, transportation bottlenecks, diminishing inventories and low investment before the pandemic. Despite unofficial import restrictions, China has reportedly started releasing some Australian coal stuck at Chinese ports amid severe power shortages. At least over the next year, coal demand is likely to remain strong to fuel power generators in Asia and for steel and industrial production, particularly for Australia’s higher-grade coal.

The fall in iron ore prices from recent highs of US$230 per tonne in May to US$120 in October (Chart) will reduce iron ore export earnings in 2021-22, as has been expected by the Australian Government. Beijing’s efforts to limit 2021 steel output (to 2020 levels) and reduce energy emissions, alongside an increase in Brazilian supply, are dragging on prices. Risks of a sharper slowing in Chinese property construction also weighs on the outlook for iron ore. China’s power shortages may also reduce economic activity and curb demand for other Australian exports, including alumina, bauxite and wool.