Nepal

Nepal

Last updated: March 2023

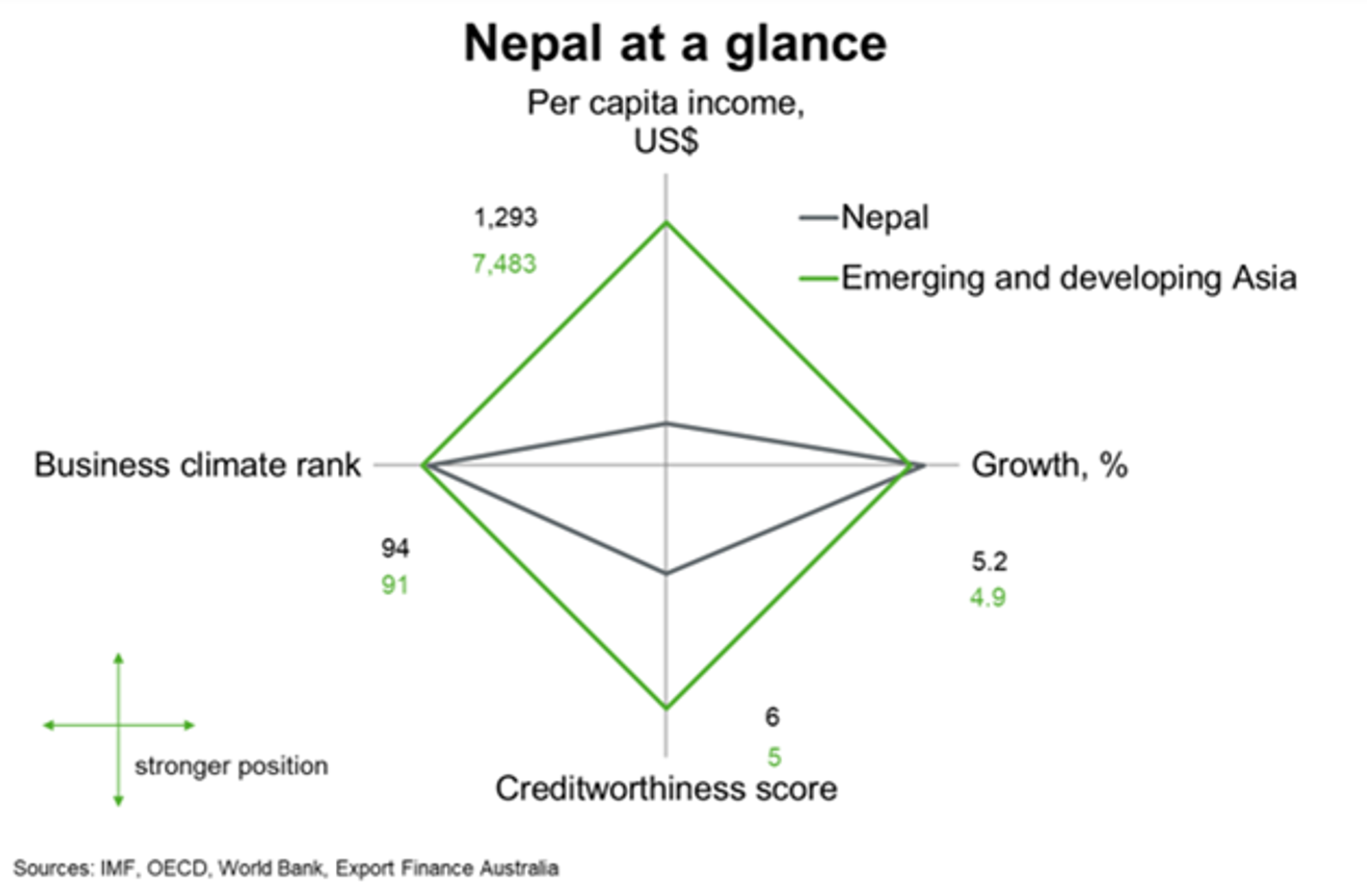

Nepal performs in line with emerging and developing Asia on indicators of economic growth and the business climate but lags on measures of income and creditworthiness. Nepal aims to become a middle-income economy by 2030 and high-income country by 2043, as per the country’s latest five-year development plan. Nepal aims to do this by increasing production and productivity, enhancing education and upskilling the workforce and reducing vulnerability to market and sector-specific shocks.

| The above chart is a cobweb diagram showing how a country measures up on four important dimensions of economic performance—per capita income, annual GDP growth, business climate rank and creditworthiness. Per capita income is in current US dollars. Annual GDP growth is the five-year average forecast between 2023 and 2027. Business climate is measured by the World Bank’s 2019 Ease of Doing Business ranking of 190 countries. Creditworthiness attempts to measure a country's ability to honour its external debt obligations and is measured by its OECD country credit risk rating. The chart shows not only how a country performs on the four dimensions, but how it measures up against other countries in the region. |

Economic outlook

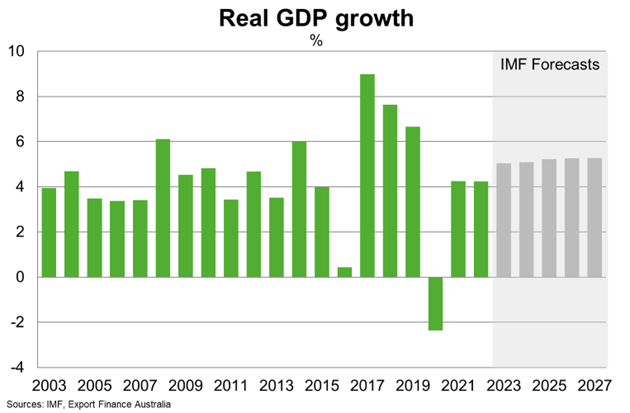

A downturn in tourism due to international border restrictions led to Nepal’s first economic contraction in almost 30 years in 2020. A strong recovery in domestic consumption and investment on the back of pent-up demand and low interest rates supported growth of 4.2% per annum in 2021 and 2022.

The IMF forecasts growth to accelerate to 5% in 2023 and remain around that rate in 2024. A further recovery in tourism on the back of rising international travel demand and improvements to domestic infrastructure, such as the Gautam Buddha International Airport, will support faster growth in the services sector, and the broader economy. Nepal should continue to receive solid remittances inflows, particularly from workers in the Gulf countries; remittances, which account for around 20% of GDP, support household incomes and consumption. But still high commodity prices that boosts the imports bill and the unwinding of monetary and fiscal stimulus measures will weigh on domestic demand. Agriculture output, which is equal to roughly 25% of GDP and about 80% of all employment, will slow due to a continued shortage of chemical fertilisers; the shortage will be partly mitigated by a five-year fixed supply agreement between India and Nepal.

The IMF expects growth to average 5.2% per annum between 2024 to 2027. The IMF provided Nepal with a 38-month Extended Credit Facility in January 2022 to support long term economic development. The IMF program includes reforms to reduce the cost of doing business and barriers to foreign investment, especially in high-value agricultural products and tourism. Nepal also aims to invest in resilient infrastructure and boost agricultural productivity to address risks related to food security and natural disasters. Demographic pressures will pose the greatest economic challenge over the longer term, such as an aging population and declining fertility rate.

The risks to the outlook are tilted to the downside. The prospect of even higher inflation and additional restrictions on luxury goods imports (that results in domestic suppliers increasing prices) would hurt household budgets. A sharp fall in commodity prices would reduce the import bill and ease trade imbalances. But a strong correction in oil prices that lowers demand for migrants in Gulf countries would weigh on remittances inflows. Natural disasters and extreme climate events remain an ever-present risk.

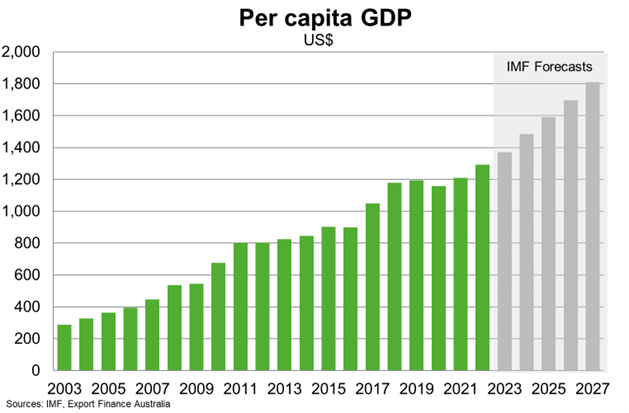

Nepal’s strong past economic performance has steadily lifted incomes. The IMF expects GDP per capita to rise above US$1,800 in 2027, from an estimated $1,300 in 2022. However, the IMF projects around 22% of jobs lost during the pandemic had not been recovered by 2022. An uneven and slow job recovery could hamper efforts to reduce poverty and income inequality.

Country risk

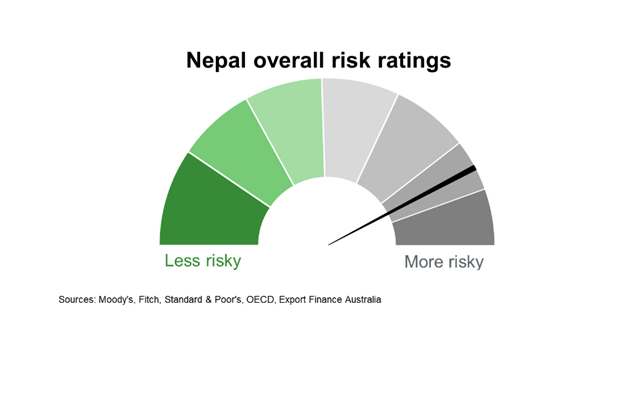

Country risk in Nepal is high. The OECD country risk rating is 6. This indicates an elevated risk of Nepal being unable and/or unwilling to meet its external debt obligations. Nepal is not rated by the three major private ratings agencies.

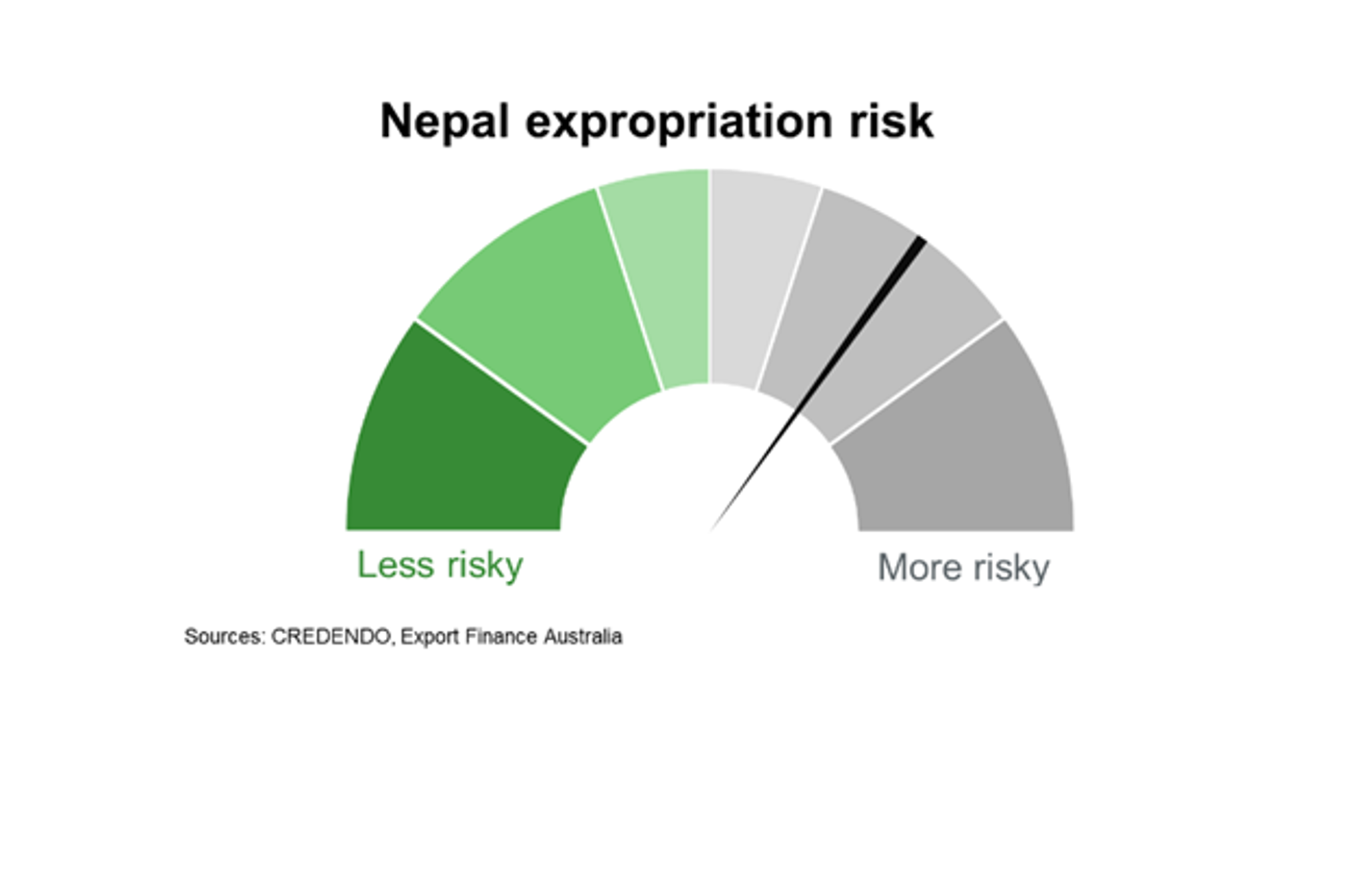

The risk of expropriation in Nepal is moderate to high. The US investment climate statements indicate that companies can be sealed if they do not pay taxes in accordance with Nepali law and bank accounts can be frozen if authorities have suspicions of financial crimes.

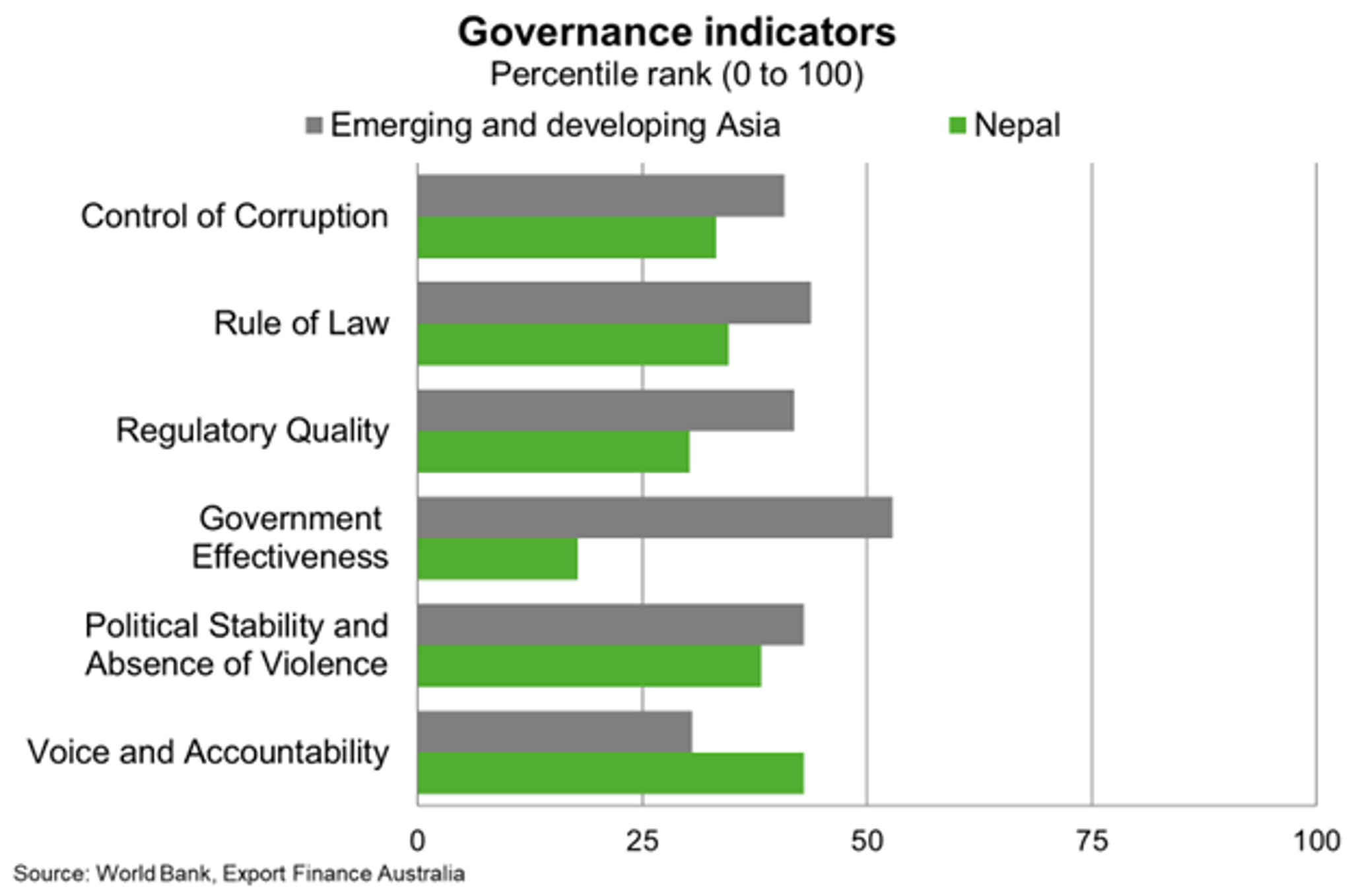

Nepal underperforms most of the emerging and developing Asian region on most measures of governance. Constraints around the rule of law and perceived corruption hinder the business climate. Nepal performs better on indicators of voice and accountability relative to peers.

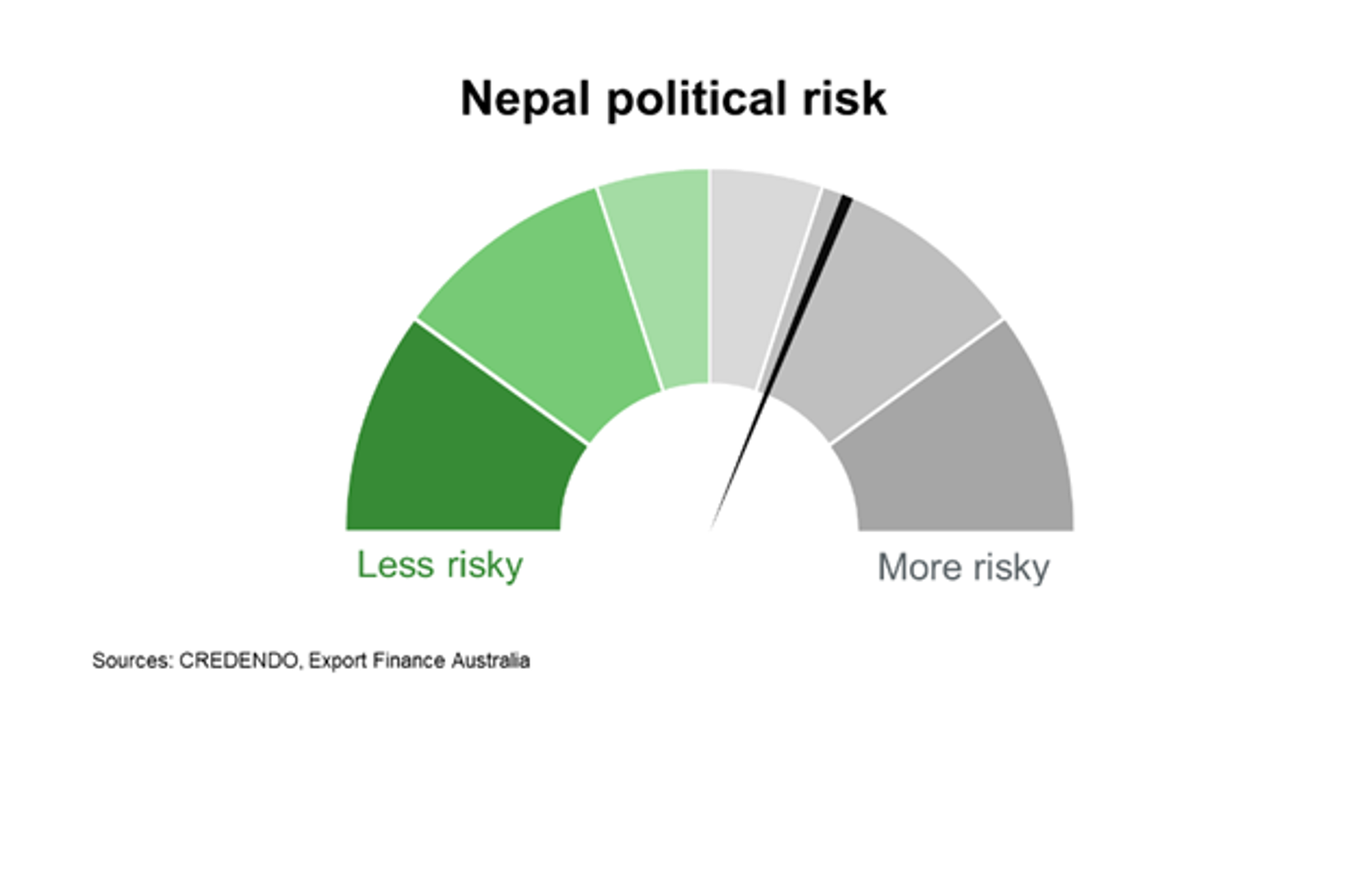

Political risk is moderate to high. Nepal’s political history has been characterised by frequent leadership transitions and coalitions consisting of multiple political parties. Domestic political tensions can challenge policymaking and undermine legislative progress on much-needed structural reforms. Public discontent with the government and cost of living pressures can lead to protests and social unrest.

Bilateral relations

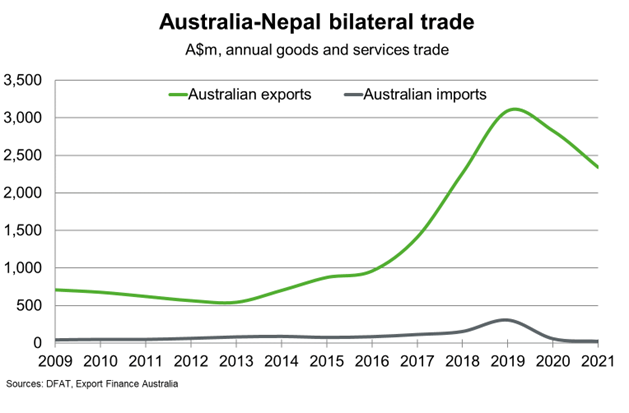

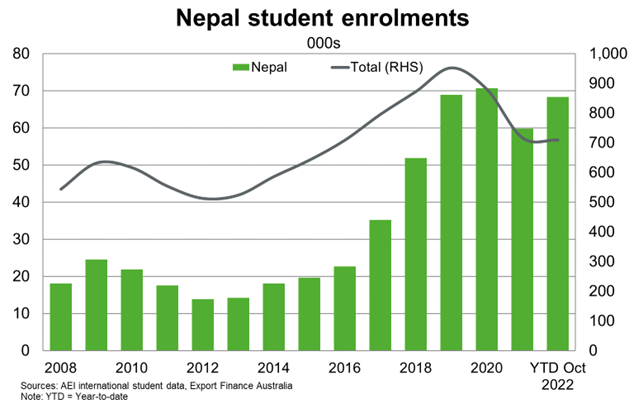

Nepal was Australia’s 36th largest trading partner in 2021. Total goods and services trade amounted to $2.4 billion in 2021. Education-related travel accounted for around 90% of Australia’s total exports to Nepal in 2021. Nepal’s ongoing efforts to address skills gaps in education and training presents increasing opportunities for Australian vocational education providers. Australia also exports goods such as seeds, fruits and vegetables to Nepal. Australia’s imports from Nepal are minimal.

Nepalese students are the third largest source of international student enrolments in Australia; student enrolments are around 70,000, having increased more than three-fold between 2010 to 2020. Enrolments held up through the pandemic thanks to remote learning services.

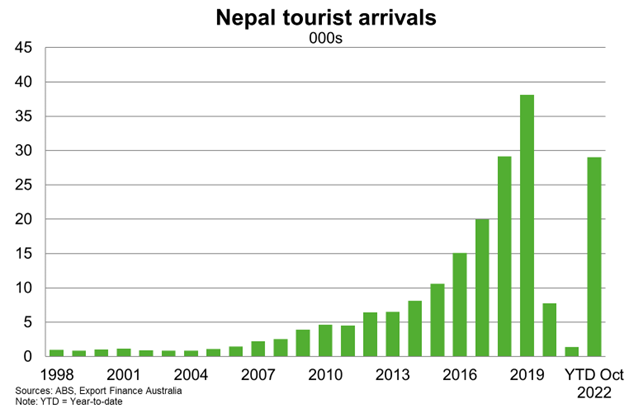

The recovery in Nepalese tourism to Australia has been strong; by October 2022, tourism arrivals had recovered to around 75% of their pre-pandemic level. Another year of open international borders and pent-up demand for travel should support further recovery in tourism, and broader services exports, in 2023.