United Arab Emirates

United Arab Emirates

Last updated: January 2023

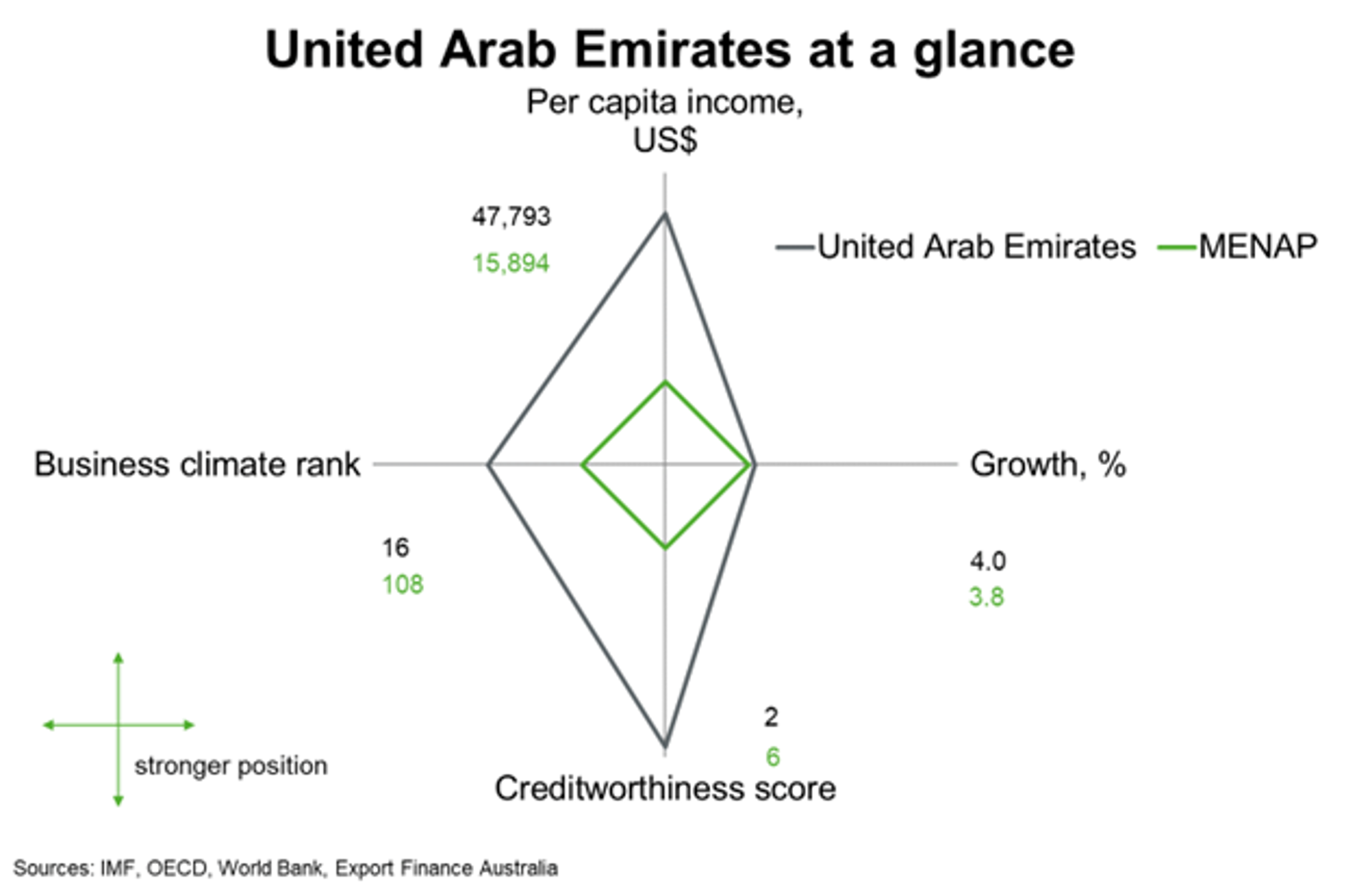

The United Arab Emirates (UAE) is the third largest economy in the Middle East, behind Iran and Saudi Arabia. The UAE has higher per capita incomes, business climate rank and creditworthiness score compared to MENAP neighbours (Middle East, North Africa, Afghanistan and Pakistan), while growth is in line with the regional average. The UAE is a major hub for Australian businesses looking to expand into the MENAP region. Most of the UAE is highly dependent on energy exports to drive output and incomes; however, recently the UAE has been increasingly diversifying its economy towards tourism and services sectors.

The above chart is a cobweb diagram showing how a country measures up on four important dimensions of economic performance—per capita income, annual GDP growth, business climate rank and creditworthiness. Per capita income is in current US dollars. Annual GDP growth is the five-year average forecast between 2023 and 2027. Business climate is measured by the World Bank’s 2019 Ease of Doing Business ranking of 190 countries. Creditworthiness attempts to measure a country's ability to honour its external debt obligations and is measured by its OECD country credit risk rating. The chart shows not only how a country performs on the four dimensions, but how it measures up against other countries in the region.

Economic Outlook

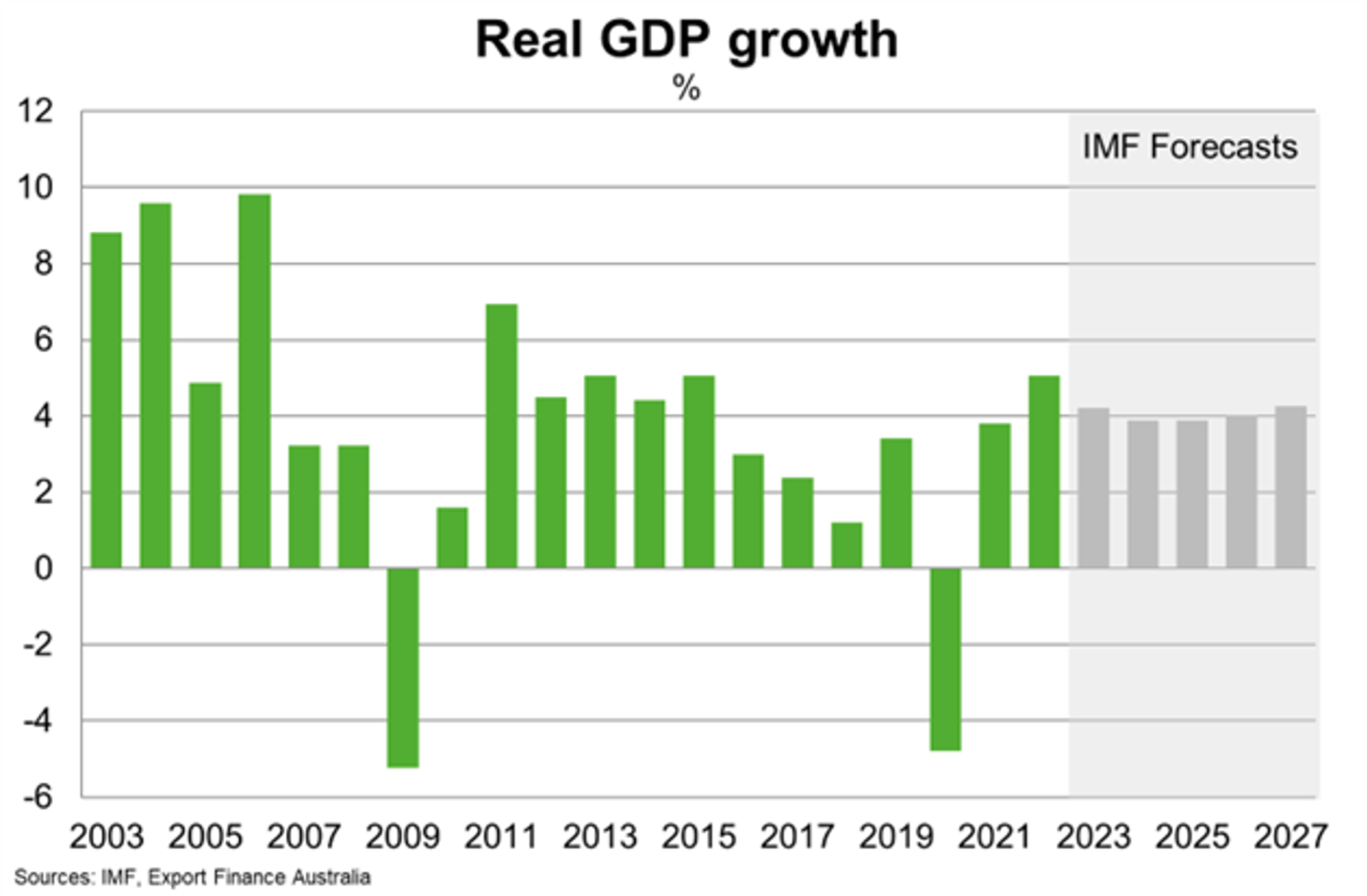

The World Bank estimates that growth in the United Arab Emirates (UAE) accelerated to 5.9% in 2022 from 3.9% in 2021, following strong recovery in tourism and construction industries and higher oil production in line with OPEC+ targets. Recent geopolitical developments prompted an increase in financial inflows to the UAE.. That contributed to 20%-40% increase in house prices in Dubai and improved the financial and external position. Dubai’s status as a tourist and financial hub also helped the emirate benefit from increased tourism and hospitality services when Qatar hosted the FIFA 2022 World Cup.

The outlook is positive, supported by domestic consumption. The IMF expects growth to stabilise at 4% per annum between 2023 to 2027, on the back of growing tourism, hospitality, real estate and manufacturing activity. Developments in domestic capital markets, including the issuance of local currency debt by the federal government, will diversify the government’s borrowing sources and support fiscal spending. On the downside, OPEC+ production quotas and lower oil prices will slow momentum in the oil sector.

External risks to growth include a sharper global economic slowdown, even higher inflation, more adverse geopolitical developments and cuts in OPEC+ oil production. The UAE’s healthy fiscal buffers and reforms to promote economic diversification help mitigate these risks.

Long term growth will hinge on the Dubai Economic Agenda, so-called ‘D33’. If successfully implemented, the D33 program will raise productivity in the industrial sector, promote export growth, increase foreign investment inflows and enhance the business environment.

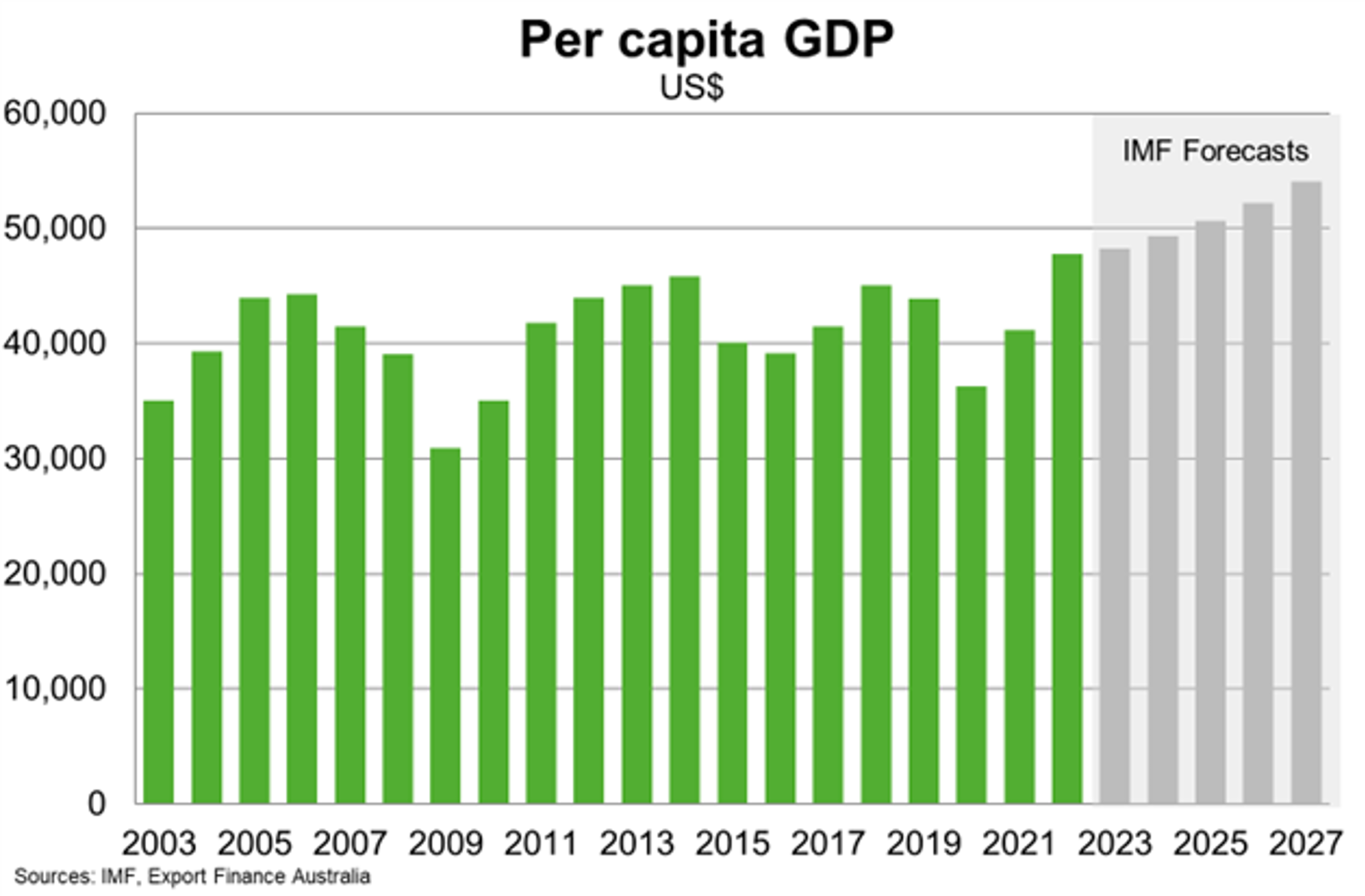

The UAE has the second-highest per capita income (US$48,000) in the MENAP region after Qatar and is expected to rise to about US$55,000 by 2027. Household incomes have been volatile due to country’s dependence on oil. But incomes should stabilise as the UAE increasingly diversifies its economy in coming years. Inequality remains an issue—according to data from the World Inequality Database—the top 10% of adult income earners in the UAE earn 50% of the country’s total income.

Country Risk

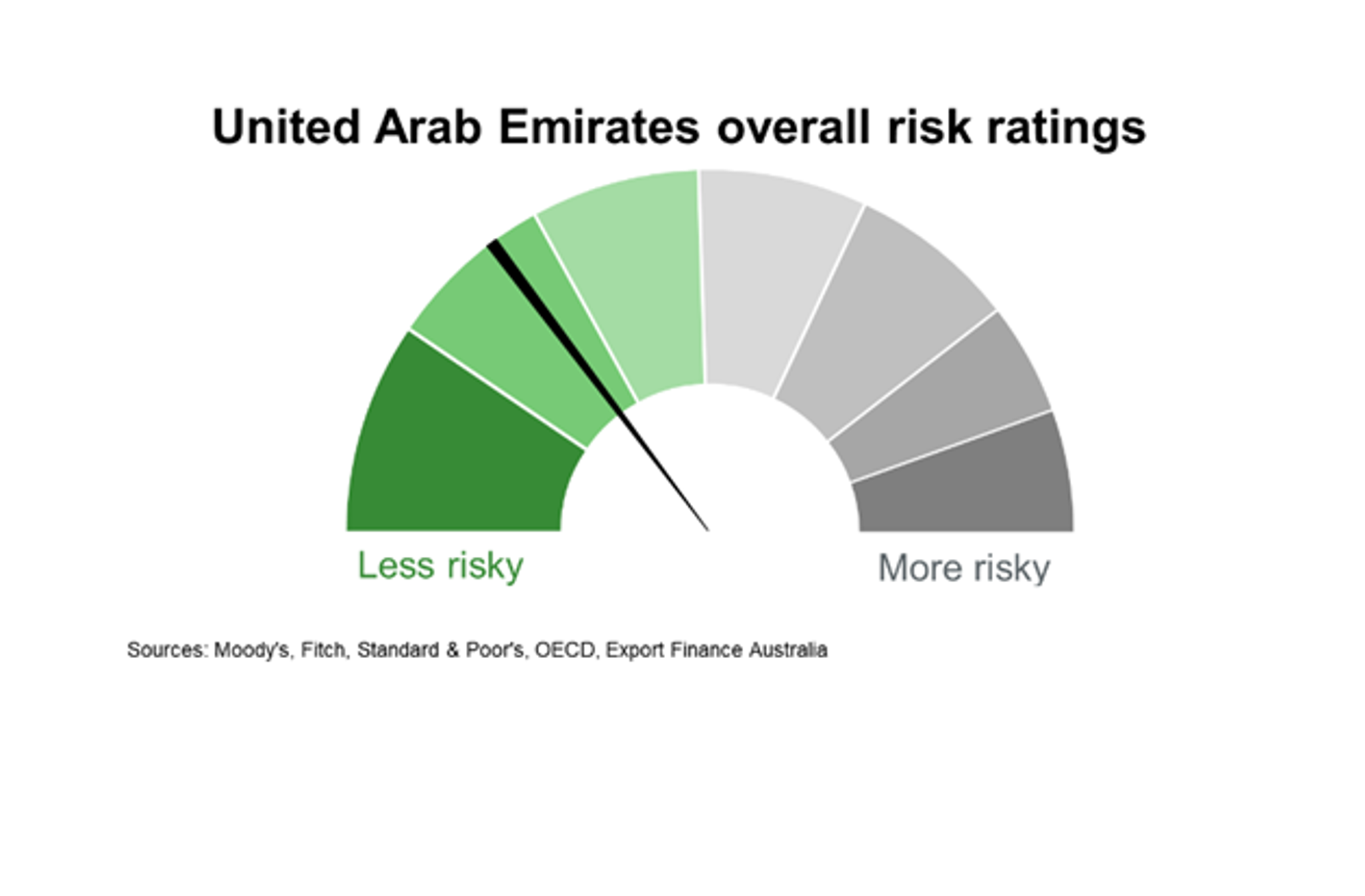

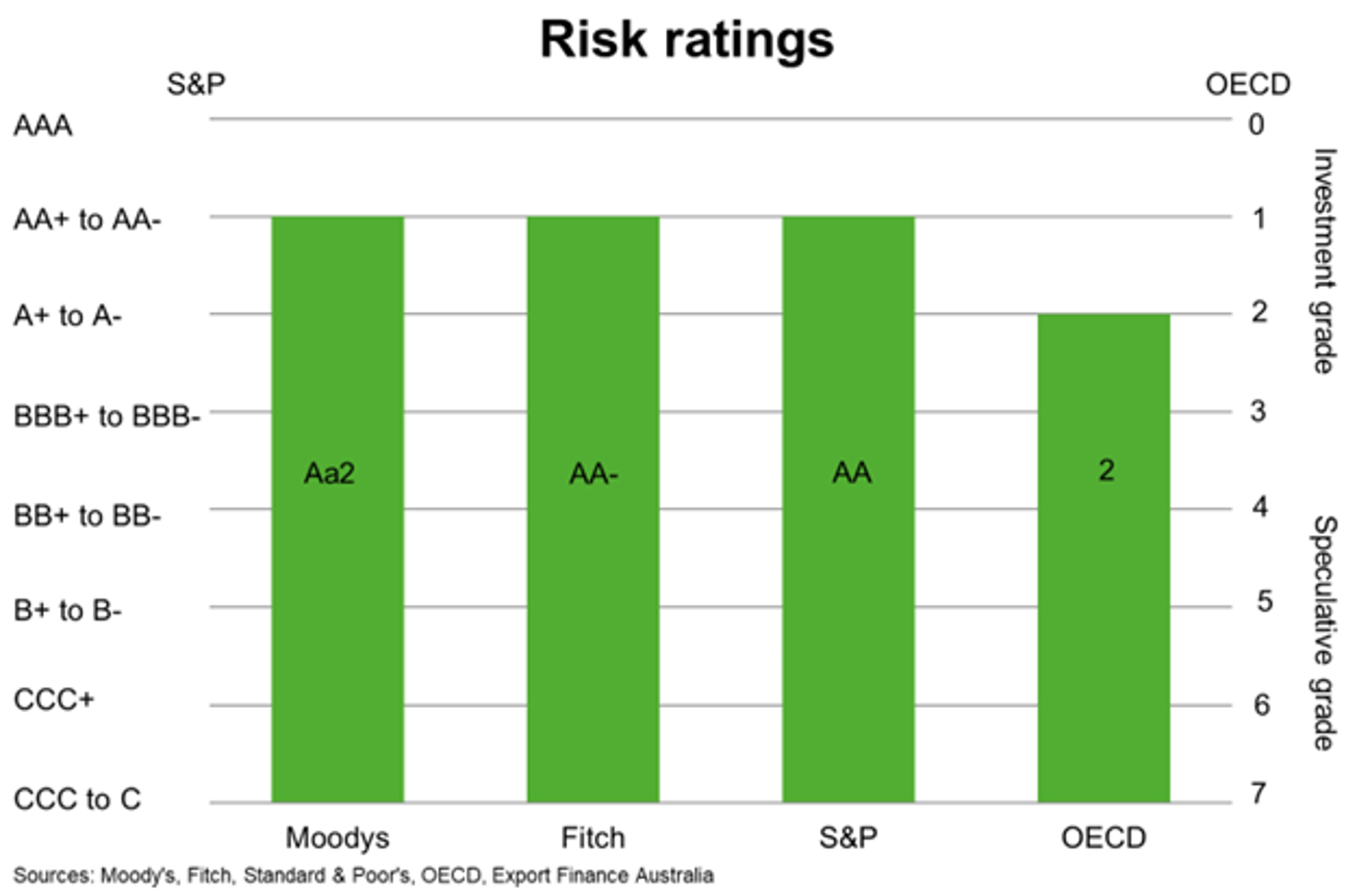

Country risk in the UAE is low. The OECD country credit grade is 2. All three major private credit ratings agencies have investment grade sovereign ratings. This means that there is a low likelihood of the country being unable/unwilling to meet its external debt obligations. Abu Dhabi’s economic weight and financial strength is a key support for other emirates in the UAE. Most laws are based on Islamic principles.

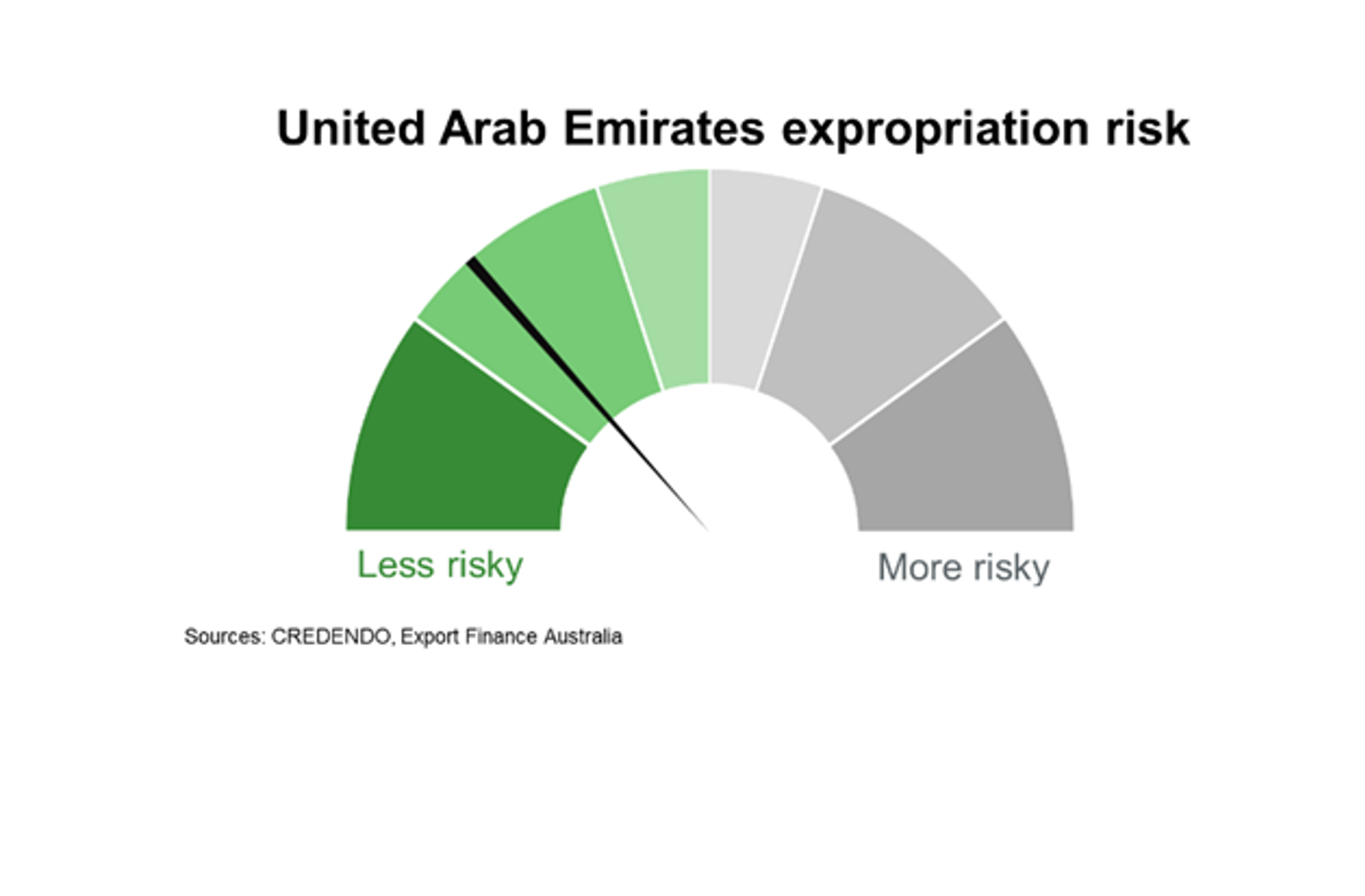

The risk of expropriation is low. There have been no reported cases of expropriation in the recent past.

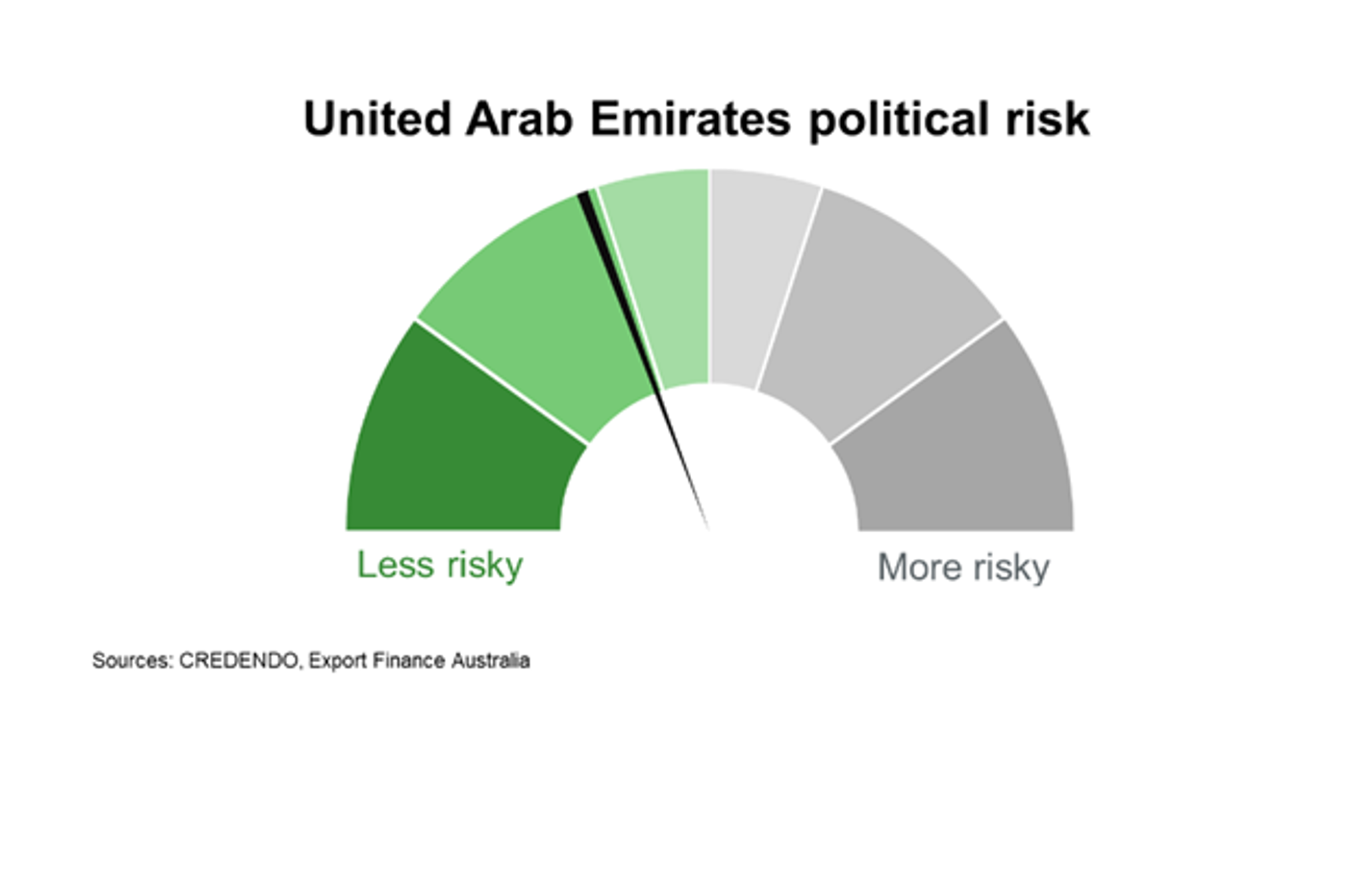

Political risk in the UAE is low to moderate, and includes risks related to escalation of regional geopolitical tensions that could hinder trade and investment.

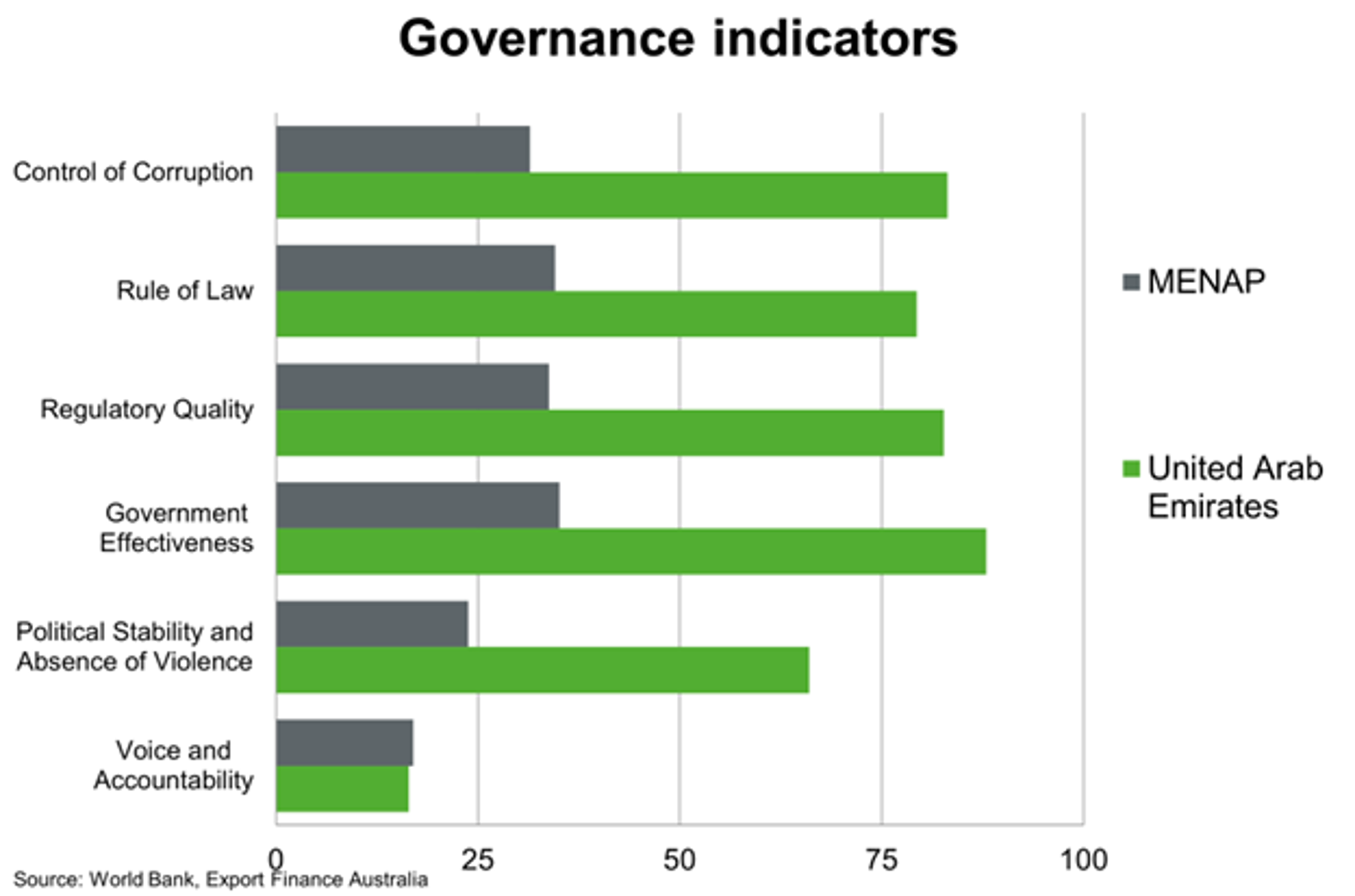

The UAE scores highly on indicators of government effectiveness, rule of law, regulatory quality and control of corruption, implying strong governance and institutional frameworks on a standalone basis and relative to other MENAP countries. However, as in many MENAP countries, the UAE scores in the lowest quartile for voice and accountability.

Bilateral Relations

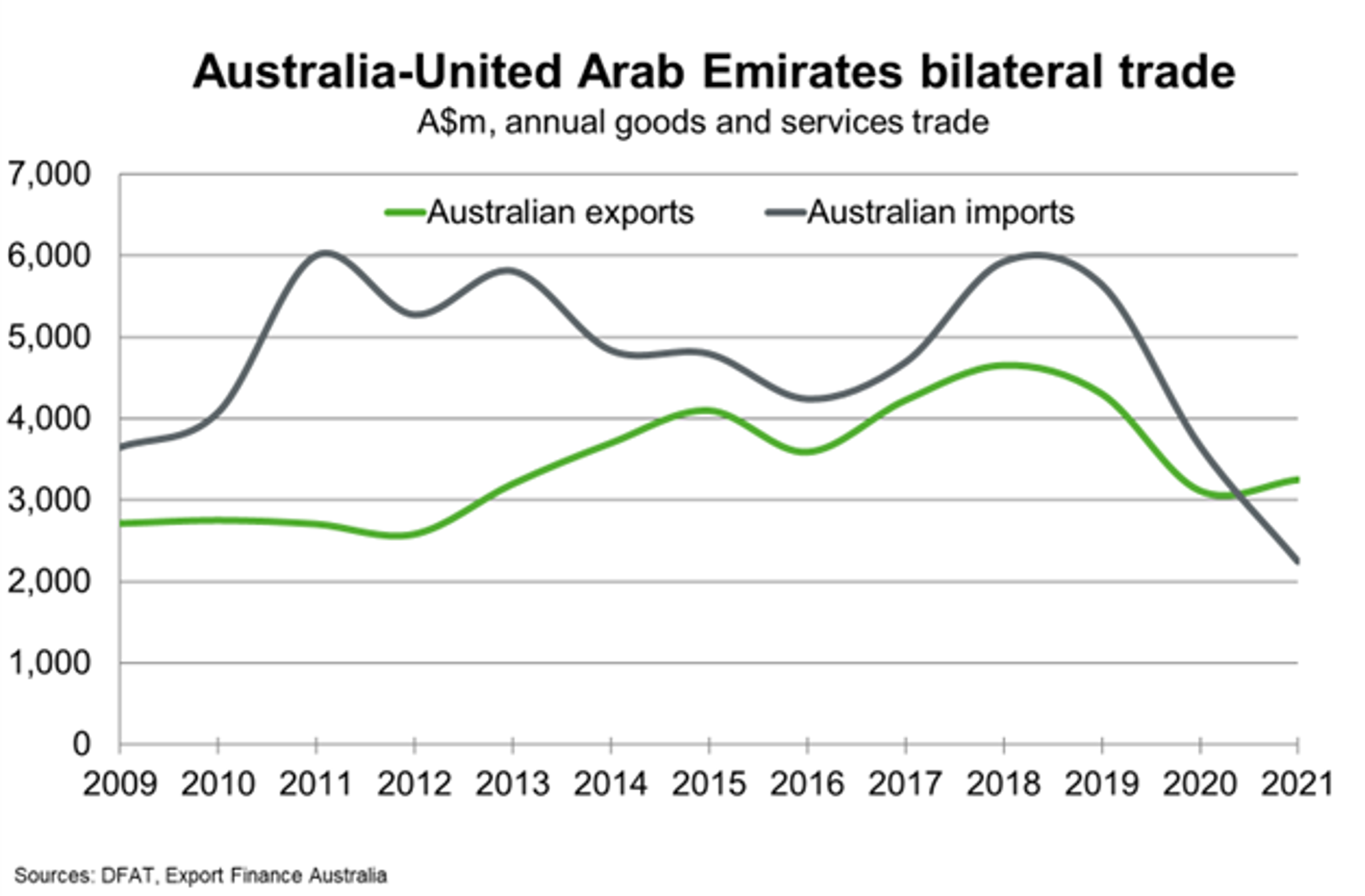

The UAE is Australia’s largest trading partner in the MENAP region and 23rd largest overall in 2021. Major Australian exports to the UAE in 2021 included meat and beef, seeds and fruits, vehicle parts and accessories and telecommunication equipment. Transport services, fertilisers, copper, and refined petroleum were Australia’s biggest imports from the UAE in 2021. The UAE is a major hub for Australian businesses looking to diversify exports into the Middle East due to its favourable transport, financial and communications infrastructure. Potential export opportunities in the UAE include aviation, food and beverages and water solutions.

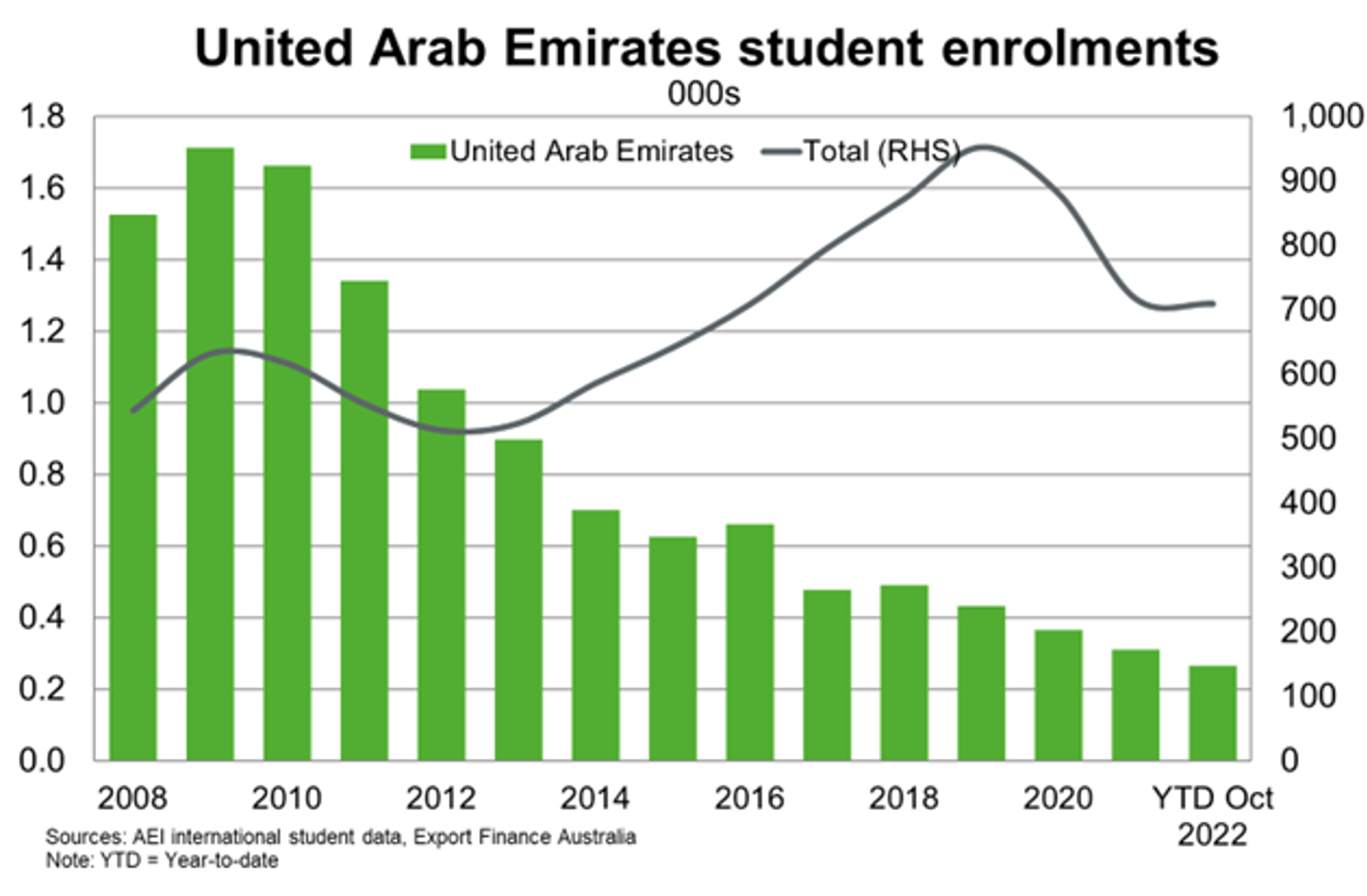

Student enrolments continued their downward trend from their peak in 2009. Notwithstanding competition from international institutions, education remains a key sector offering strong export potential, given Australian universities such as the University of Wollongong, Murdoch University and Curtin University all have campuses in the UAE.

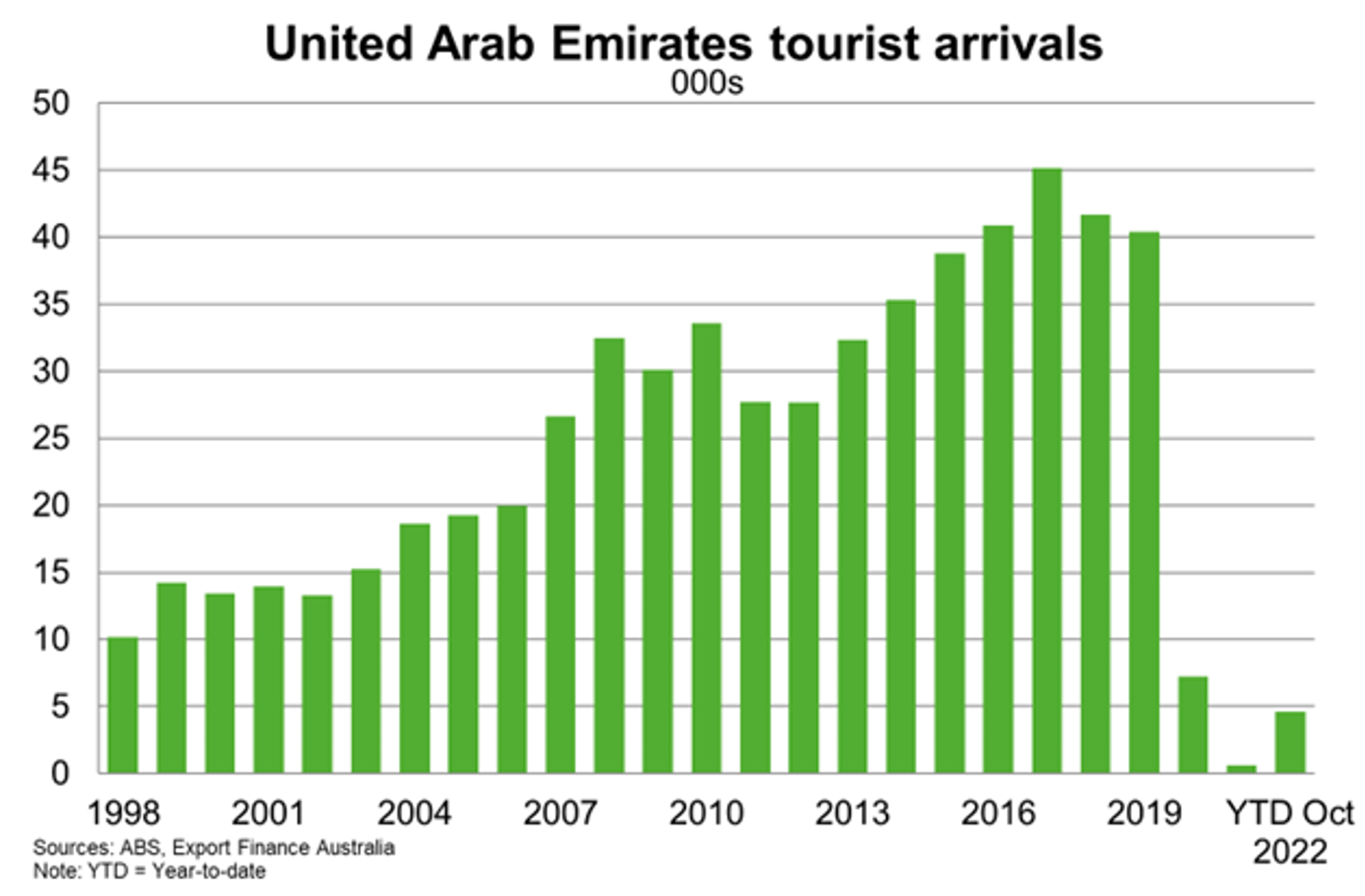

Tourist arrivals remained low through 2022. Another year of open international borders should support recovery in UAE demand for Australian tourism, and broader services exports, in 2023.

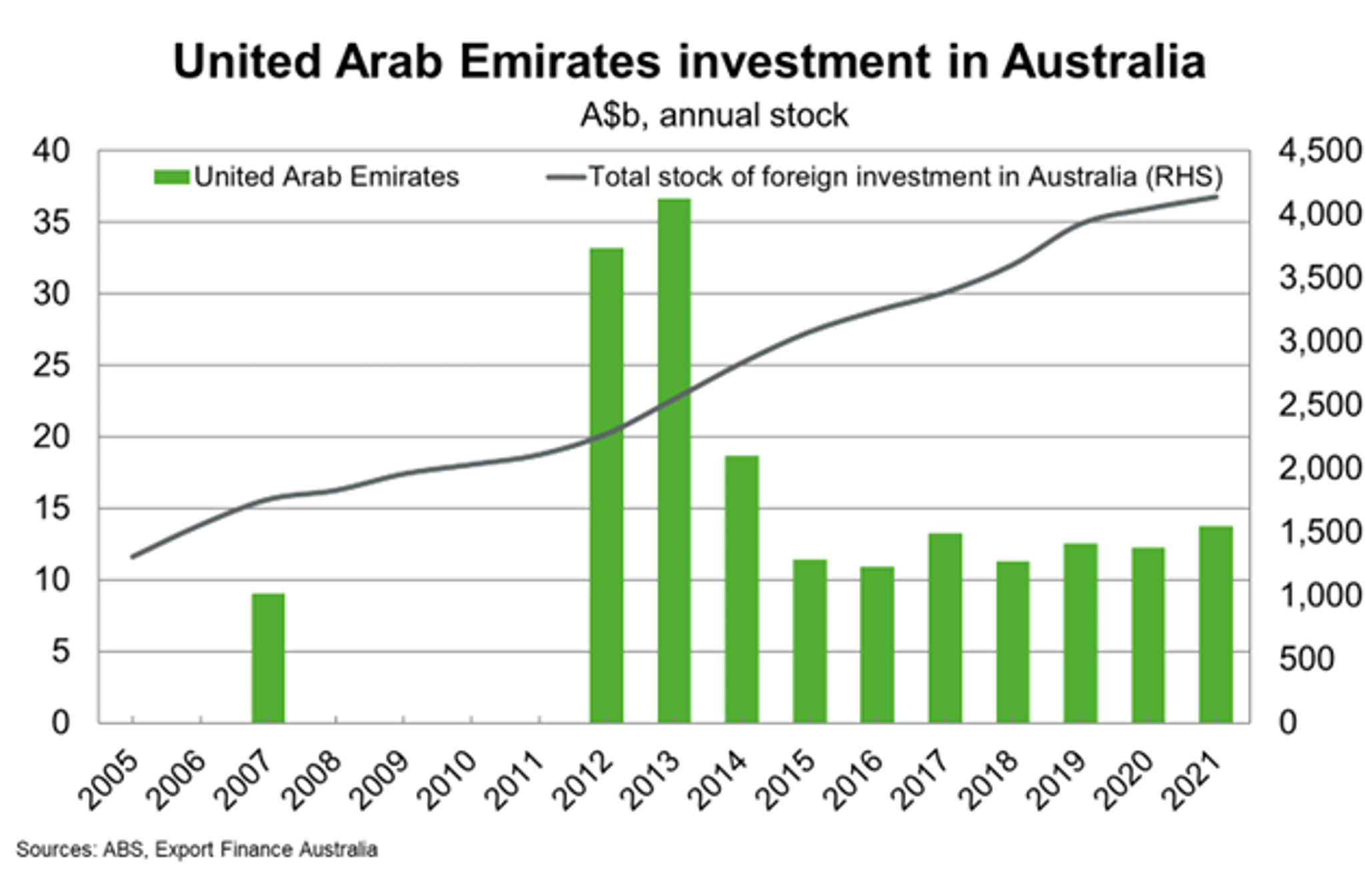

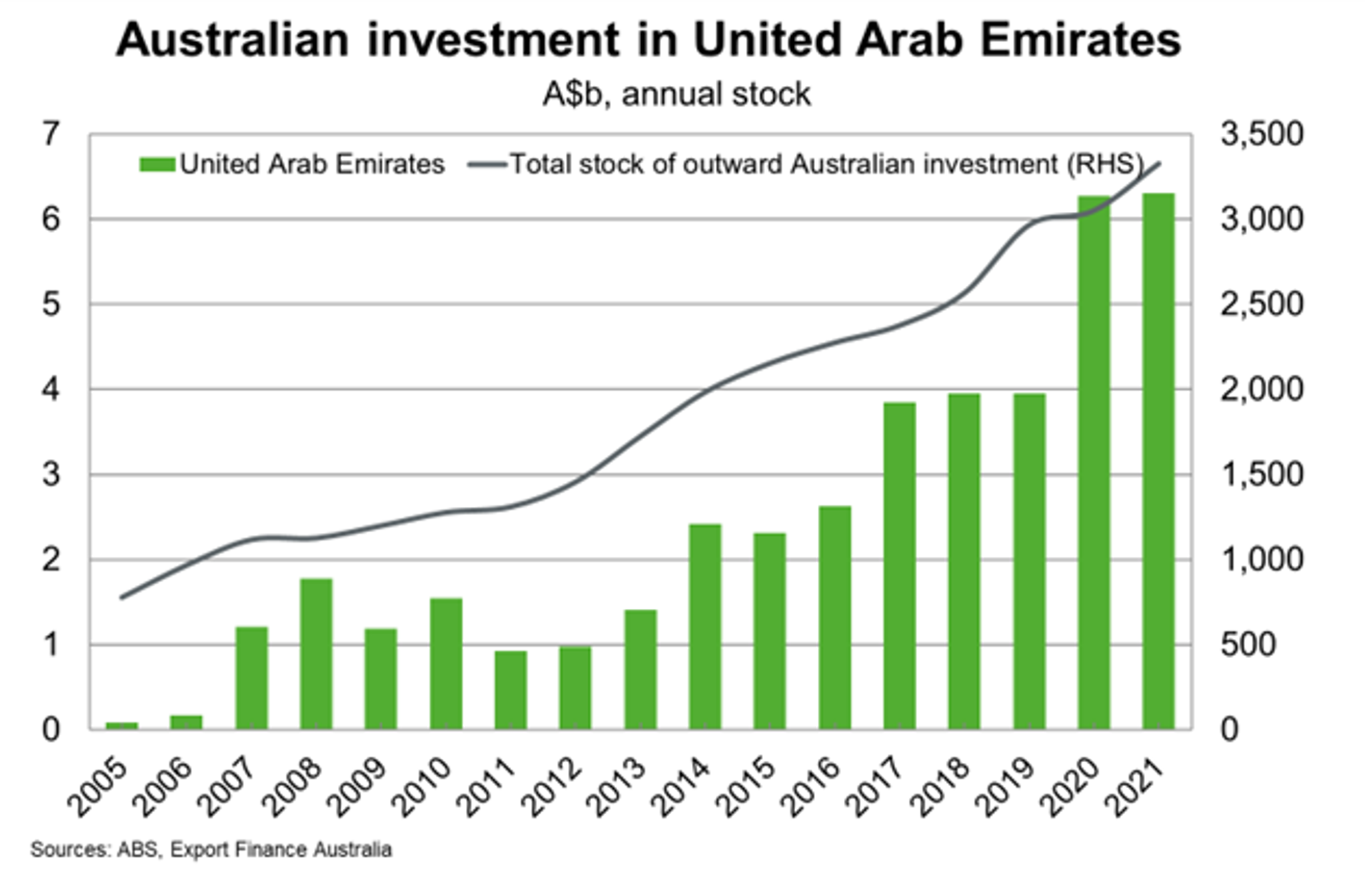

UAE investment in Australia stood at $13.7 billion in 2021. Sovereign wealth funds contribute the most towards investment in Australia. For example, the Abu Dhabi Investment Authority has invested in ports, TransGrid electricity network and Queensland Motorway project. Australian investment in the UAE amounted to $6.3 billion in 2021, and has risen overtime as Australian companies use Dubai as a regional base for operations, given the emirate’s comprehensive transport, financial and communications infrastructure.

Useful links

Department of Foreign Affairs and Trade

United Arab Emirates Country Brief

Austrade

United Arab Emirates Market Profile